Tata Motors, the parent company of Jaguar Land Rover, has chosen the UK for its new electric vehicle battery plant, planning a landmark £4 billion investment. This significant move is set to generate roughly 4,000 jobs and boost the country's position in the global EV battery race.

Tata Motors confirmed its plans to construct its EV battery factory in the U.K. This will be the country's flagship production facility. The building is set to be built in Somerset, and once in full operation, the company is expected to generate about 4,000 jobs and a lot more in its supply chain that will eventually expand as well.

According to BBC News, Tata Motors' £4 billion investment is for the main site only. It is understood that it will also receive subsidies from the government which could be worth hundreds of millions of pounds. This project is considered the most significant investment in the automotive industry in the U.K. since Japan's Nissan Motors arrived in the 1980s.

This is being seen as a major achievement for Britain as it is attempting to catch up in the EV battery race that is currently ongoing worldwide, Reuters reported. Many companies are building their own EV battery factories as car manufacturers shift from gas to electric cars.

In any case, it was reported that the company had been negotiating for months before it was able to successfully secure financial support for its gigafactory from the U.K. government. On Wednesday, July 19, Tata Motors received a large incentive offer for the EV battery plant.

U.K.'s Prime Minister Rishi Sunak told BBC that its decision to grant subsidies to Tata Motors was based on various factors. The government may give these subsidies as cash, discounts on energy costs, grants, and research funding.

"Tata is an international business and will consider a number of factors when deciding where to invest. Last autumn the chancellor cut taxes specifically so that we could encourage investments like this," the PM stated.

He added, "We are making lots of changes and it is this whole package that's attractive, like investment in skills and apprenticeships, infrastructure in road, rail and broadband. It is also the approach we are taking to regulation after leaving the E.U."

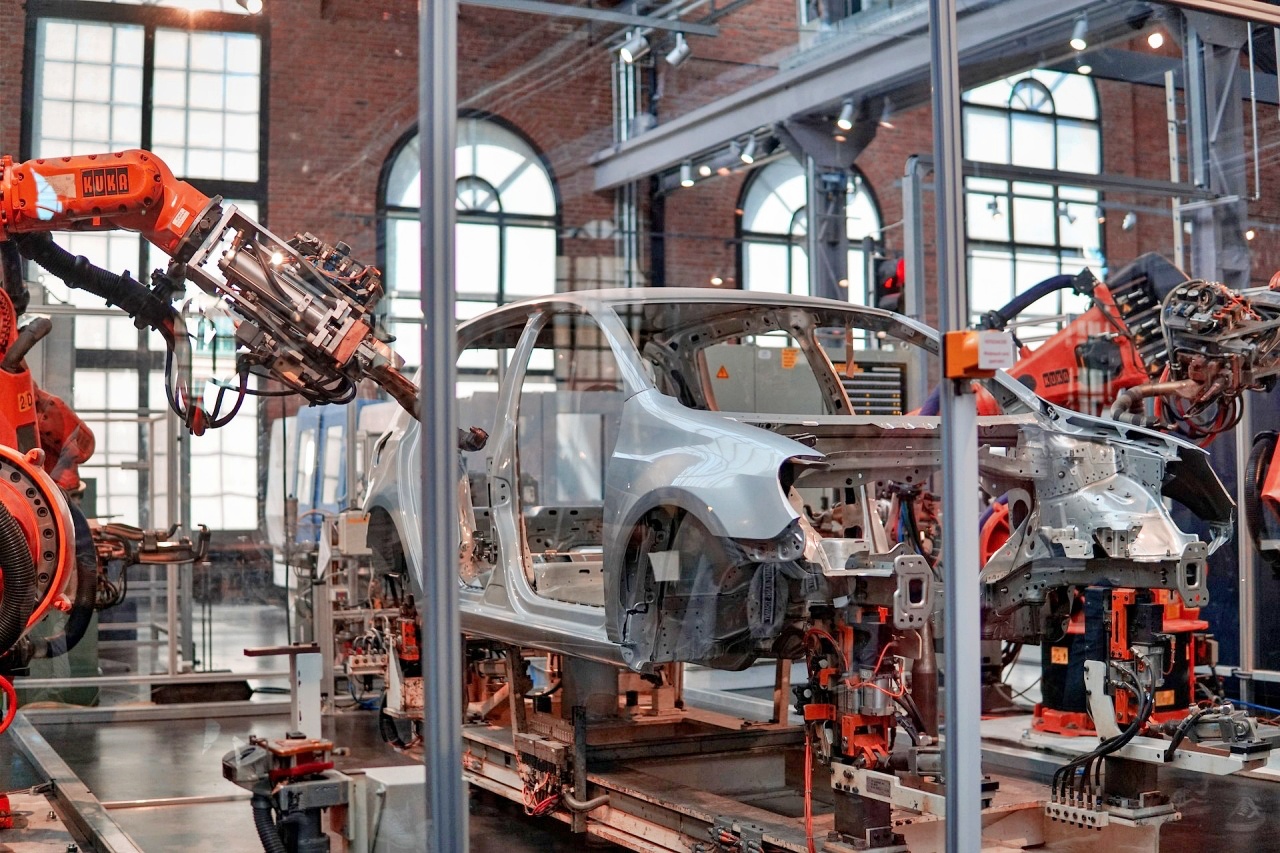

Photo by: Lenny Kuhne/Unsplash

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate