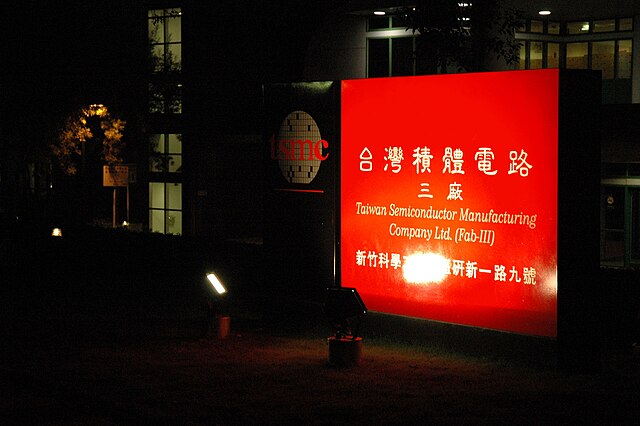

Taiwan Semiconductor Manufacturing Co. (TSMC), the leading global producer of advanced chips powering artificial intelligence (AI) applications, is expected to announce a 58% jump in fourth-quarter profit. Analysts estimate TSMC's net profit for Q4 at T$377.95 billion ($11.41 billion), up from T$238.7 billion a year earlier, driven by surging AI demand.

TSMC, whose major clients include Apple and Nvidia, has benefited from the growing adoption of AI technologies. The company recently reported a significant increase in Q4 revenue, surpassing market expectations. On Thursday, it will reveal its revenue outlook in U.S. dollars during its earnings call.

Despite its strong performance, TSMC faces challenges, including U.S. technology export restrictions on China and uncertainty over potential tariffs under the incoming Trump administration. However, Arete Research analyst Brett Simpson noted that TSMC’s investment in Arizona—a $65 billion commitment to three factories—positions it favorably as the largest foreign direct investment project in the U.S. This could strengthen its relationship with the administration.

Chairman Edward Chen of Fubon Financial highlighted the importance of progress on TSMC's Arizona fab, particularly yield rates, for the company’s future performance. Meanwhile, TSMC plans to increase its capital expenditure in 2024 to over $30 billion, with expectations of even higher spending in 2025 to meet rising AI-related demand.

Last year, TSMC’s stock soared 81%, outperforming the broader market's 28.5% gain. The AI-driven boom continues to elevate Asia's most valuable company as it races to expand production capabilities.

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Robinhood Launches Credit Card for Gold Customers

Robinhood Launches Credit Card for Gold Customers  Mastercard Partners with MoonPay to Unlock Web3 Capabilities in Experiential Marketing

Mastercard Partners with MoonPay to Unlock Web3 Capabilities in Experiential Marketing  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Alchemy Pay Forms Strategic Partnership with Worldpay to Expand Cryptocurrency Payment Channels

Alchemy Pay Forms Strategic Partnership with Worldpay to Expand Cryptocurrency Payment Channels  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Robinhood CEO Vlad Tenev: Blockchain Can Open Private Markets to Retail Investors

Robinhood CEO Vlad Tenev: Blockchain Can Open Private Markets to Retail Investors  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Paytm Shares Plummet as Regulatory Crackdown Takes Toll

Paytm Shares Plummet as Regulatory Crackdown Takes Toll  Elon Musk’s X Money Launch Set to Revolutionize Digital Payments and Dominate 2025’s Fintech World

Elon Musk’s X Money Launch Set to Revolutionize Digital Payments and Dominate 2025’s Fintech World  Citi Unveils Blockchain Platform 'Citi Token Services' for Enhanced Digital Asset Interaction

Citi Unveils Blockchain Platform 'Citi Token Services' for Enhanced Digital Asset Interaction  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Kraken's Jesse Powell Criticizes SEC Over Legal Action

Kraken's Jesse Powell Criticizes SEC Over Legal Action