The driving factor behind our long-term CHF view is Switzerland's inflation outlook which will allow the SNB to keep its nominal rates lowest in the world. It has reported its CPI MoM numbers at 0.1% from previous -0.2%.

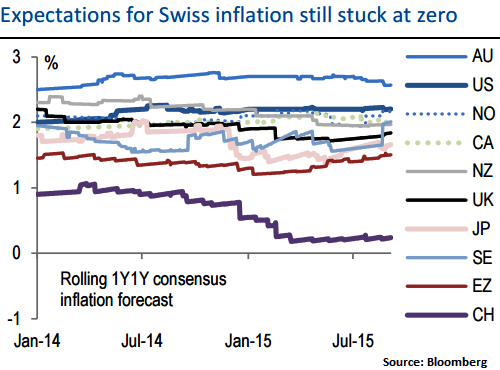

While its real rates are amongst the highest in G10, we have shown before those nominal rates are more important in driving spot FX returns. The above diagram shows updated 1Y1Y consensus expectations (year ahead inflation, 12 months out).

By 2016, Switzerland is expected to be the only G10 country with inflation still hugging zero. The SNB does not expect inflation to turn positive until early 2017 and it expects to keep rates at -0.75% throughout the forecast horizon. But the combination of previous CHF appreciation, lower commodity prices and slack in the economy all conspire to keep inflation soft and CHF slowly trending lower.

European rates are now expected an extension to ECB QE in Sept 2016 which should flatten the path for EUR/CHF next year.

Switzerland finally moves out of deflation zone

Tuesday, October 6, 2015 1:10 PM UTC

Editor's Picks

- Market Data

Most Popular

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal