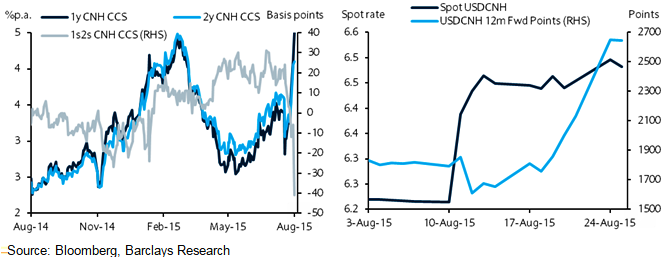

With the PBoC keeping the USDCNY fixing rather stable after its initial three moves higher, market expectations of a weaker CNY have been sharply priced into FX forward points as well as CNH CCS. Moreover, lacklustre demand for CNH assets on weaker currency expectations has been reflected in deposit rates, with the 1y CNH deposit rate rising from around 3.75% before the CNY fixing mechanism change to 5.2% currently, according to Bloomberg.

Risk-reward more balanced at current levels, as the PBoC can start moving the fix and volatility remains elevated. Although spot USDCNY is likely to reach 6.80 by year-end, the risk-reward of paying 1y CNH CCS is expected to be more balanced at the current juncture.

"Currently, the 6m forward USDCNH is indicating 6.68, which we think suggests there is more room for forwards to price in further weakness in the CNY. However, if the USDCNY fix (and thus spot USDCNY) moves higher, close to what current forwards are pricing in, then we think FX forward points could actually fall, provided that China's ongoing push for inclusion in the IMF's SDR currency basket serves to limit any extreme weakening expectations for the CNY. Looking ahead, CNH CCS is expected to remain elevated and would look to pay the 1y point if valuations richen towards 3%", says Barclays in a research note on Tuesday.

Spot USDCNY to reach 6.80 by year-end

Tuesday, August 25, 2015 4:39 AM UTC

Editor's Picks

- Market Data

Most Popular