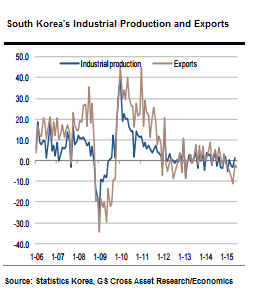

South Korea's industrial production is likely to have extended its recovery momentum in July after the sizeable turnaround in June. July trade data suggests that non-electronics sectors such as chemical and metal products outperformed the electronics sector.

Moreover, industry data shows that auto production increased for the second consecutive month in July based on the seasonally-adjusted series. Year-on-year growth probably declined from 1.2% in June to -2.5% in July despite positive mom growth, partially because of negative base effects (mom growth in July 2014 was 1.6%), says Societe Generale.

Sustained recovery in industrial production would be good news for near-term growth momentum. Whereas, Societe Generale suggests a positive sign in July industrial production should be taken with a grain of salt, due to following reasons.

- Firstly, the relationship between GDP and industrial production has not been restored yet. In Q2 2015, manufacturing production in GDP rose by 0.8% qoq, while industrial production fell by 1.0% qoq.

- Secondly, a renewed slump is expected in exports in August.

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off