Scandinavian FX experienced the impetus of central banks resolutely pointing growth in Norway and inflation in Sweden. But the policy insertion was similar despite high Norwegian inflation and high Swedish growth.

The policy shackles should finally start to loosen for SEK next year. Growth will eliminate the output gap and core inflation should see 2% -the Riksbank's hyper-sensitivity to the exchange rate is not sustainable for a local economy that is cyclically stronger and structurally sounder than the Euro area.

EUR/SEK should eventually test the bottom of this year's 9.10-9.70 range in 2H on a late-cycle decoupling of ECB and Riksbank policy. There are limits to the Riksbank's policy of shadowing the ECB given macro divergence, as there were for the SNB.

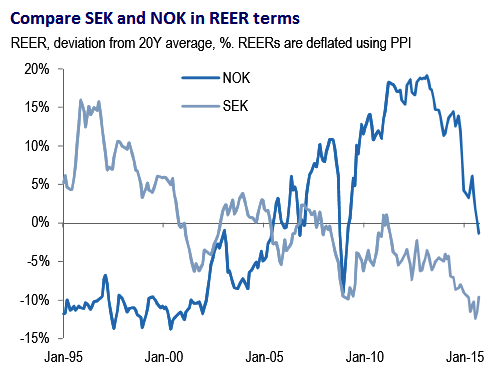

FX weakness serves the Norges Bank's purpose in facilitating longer-term economic re-balancing irrespective of the CPI consequences. The Riksbank marginally out-did the Norges Bank (35bp of rate cuts and 5% of GDP in QE versus 50bp from the Norges Bank's) yet NOK was the harder hit, falling another 13% versus USD, 3% versus SEK and 1.5% versus EUR. NOK has now lost 36% of its value vs USD since 2013. SEK has shed 25%.

The worst real rates in G10 are a dead-weight on NOK. EUR/NOK unchanged end-2016. Expect interim upward pressure, but the peak is lowered to 9.50. End 2016 Forecasts being EUR/SEK 9.05, EUR/NOK 9.20, NOK/SEK 0.98.

Scandis currency space sensing both warmer and chilly season – SEK seems cheaper than NOK

Wednesday, February 3, 2016 10:02 AM UTC

Editor's Picks

- Market Data

Most Popular

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty