Samsung Electronics leaps into the artificial intelligence (AI) chip market, planning to mass-produce high-bandwidth memory (HBM) chips this year, potentially upsetting current leader SK hynix's market dominance with superior speed and capacity.

To catch up with SK hynix, Samsung is set to mass-produce HBM3 memory chips with 16-gigabyte and 24-gigabyte capacity. These chips are known to have the fastest data processing speeds on the market, clocking in at 6.4 Gigabits per second (Gbps). This speed aids in increasing the learning calculation speed of the server, which is necessary to implement AI services properly.

Samsung is also introducing new memory solutions, such as HBM-PIM, a high-bandwidth memory chip with integrated AI processing power, and CXL DRAM, which overcomes the limitations of DRAM capacity. With these new products and increased presence in the HBM market, Samsung is expected to increase its profitability and gain competitive ground in the sluggish memory chip market.

As AI services gain traction and continue to grow, demands for high-performance and high-capacity DRAM to support these services also increase. HBM chips are the solution to this problem.

Vertical stacking of multiple DRAMs gives HBM chips an edge regarding data processing speed compared to conventional DRAM. However, this advantage comes at a cost - HBM is around two to three times the price of a standard DRAM.

Samsung will launch the next generation of HBM3P in the second half of the year with higher performance and capacity demands from the market. Its products, with a processing speed of 6.4 Gigabits per second (Gbps), could give it an edge in increasing the learning calculation speed of the server. Samsung aims to supply GPU makers in North America starting in Q4 2022.

With the memory chip industry struggling with falling demand, Samsung's move to explore new memory solutions such as HBM-PIM and CXL DRAM is timely. As Samsung introduces new products to the HBM market, it can foreseeably boost its profitability and further establish itself.

TrendForce expects the HBM market to grow at an annual growth rate of up to 45 percent from 2022 to 2025, making this an exciting time in the high-bandwidth memory chip market.

According to industry analysts, the market leader, SK hynix, currently holds around a 50 percent market share, with Samsung accounting for 40 percent and Micron close behind with 10 percent. The HBM market is still new and only accounts for about 1 percent of the entire DRAM market. However, the industry is expected to grow at an annual rate of up to 45 percent from this year until 2025, according to market tracker TrendForce.

In the fourth quarter of this year, Samsung is expected to begin supplying HBM3 to GPU makers in North America. As the market for generative AI services grows, HBM chips used for AI servers are gaining traction in the memory chip industry. With the AI era in full swing, the demand for HBM products is expected to increase dramatically, making Samsung's move into the AI memory chip market well-timed and highly strategic.

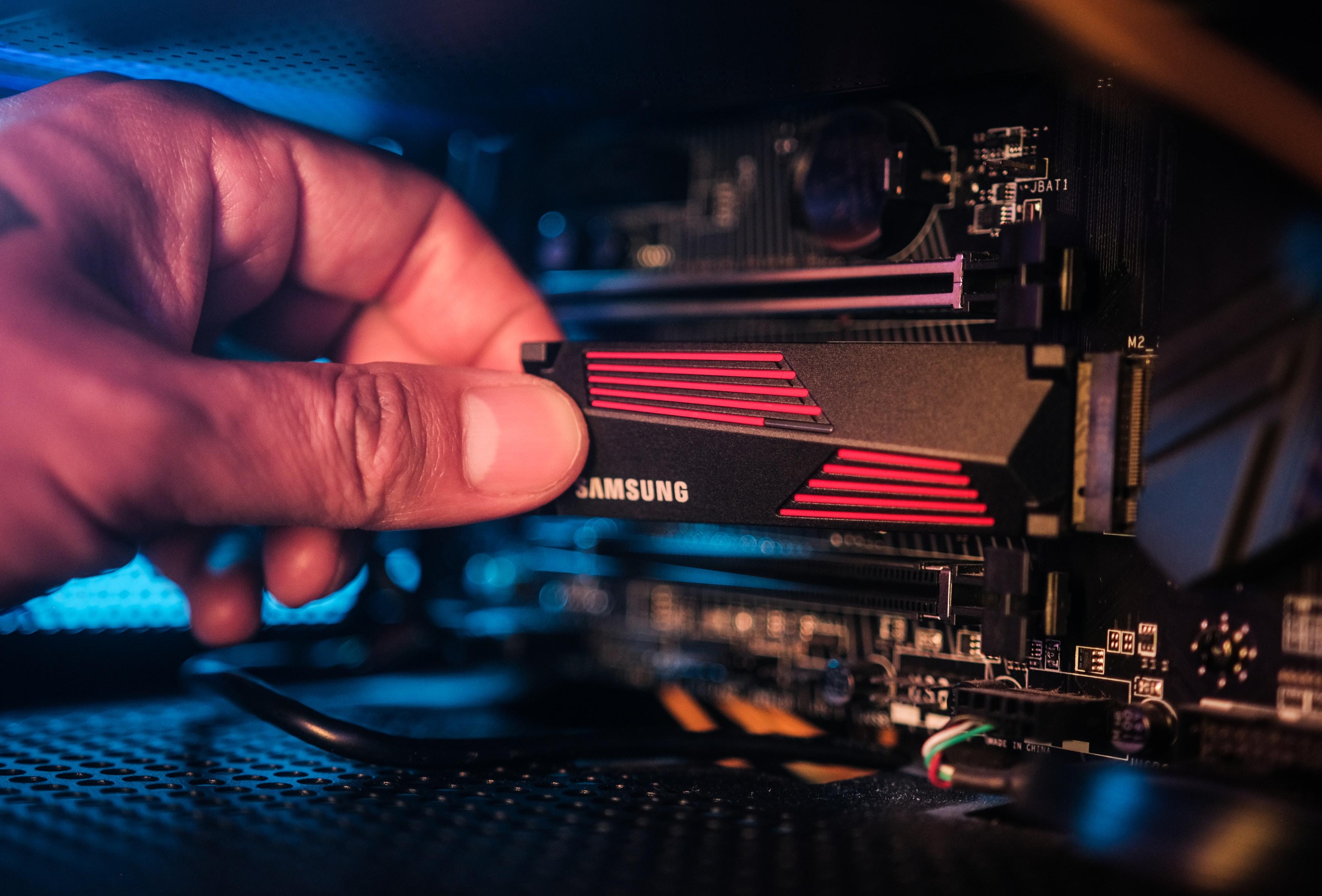

Photo: Samsung Memory/Unsplash

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers

SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers  SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers

SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns