S&P 500 is down for fourth consecutive day and down close to 0.6% today in CFD in thin volume Monday's Asian market. S&P 500 traded as low as 2003 before bouncing back on profit booking. If bulls are able to halt the decline beyond psychologically important 2000 mark, risk appetite might return by end of the week.

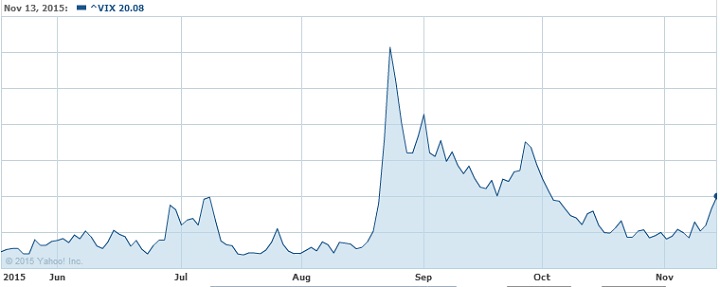

However, as of now SP 500 is clearly at the jaws of bear and latest move seem to be sparking risk aversion. CBOE's VIX index, which measures implied volatility via options market and known as fear gauge ticked up highest level in more than a month. As of Friday's close CBOE VIX is at 20.08, highest since October 2nd. Despite the recent pickup in volatility, VIX is much lower than the levels seen during August market turmoil.

Two mega risk event is scheduled for next month. European Central Bank (ECB) is expected to announce monetary stimulus, while FED is expected to hike rates for first time since 2006.

These two events pose a dilemma for bulls and bears, while can stroke risk aversion, other might increase risk appetite.

S&P500 is currently trading at 2015.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate