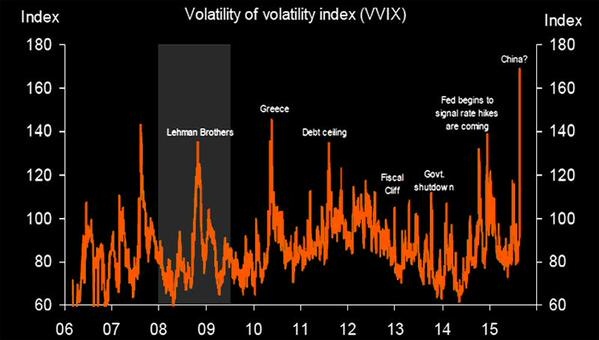

The above chart shows that VVIX index (volatility of VIX index) rose to record, over current market turmoil, thanks to China, whose economic concern has created massive headwinds for global economy.

VIX is known as the fear index, which measures expected volatility by market participants using options market implied volatility. As investors panic and rush to sell the market, VIX moves up.

Now, VVIX represents volatility of the volatility index over the next 30 days, which is measured using similar method that of VIX.

As of now VVIX is hovering well above 150, well above prior highs of Lehman brothers' crash of 2008/09, European debt crisis of 2010/11, US debt ceiling of 2011/12 and Taper tantrum of 2013.

It can be said with certain degree of certainty that volatile days are here to stay in financial markets. Even if the volatility abates slowly, there could be spike and spark based on news and events.

Yen is likely to perform well in tumultuous market as well as high volatility strategies such as momentum.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?