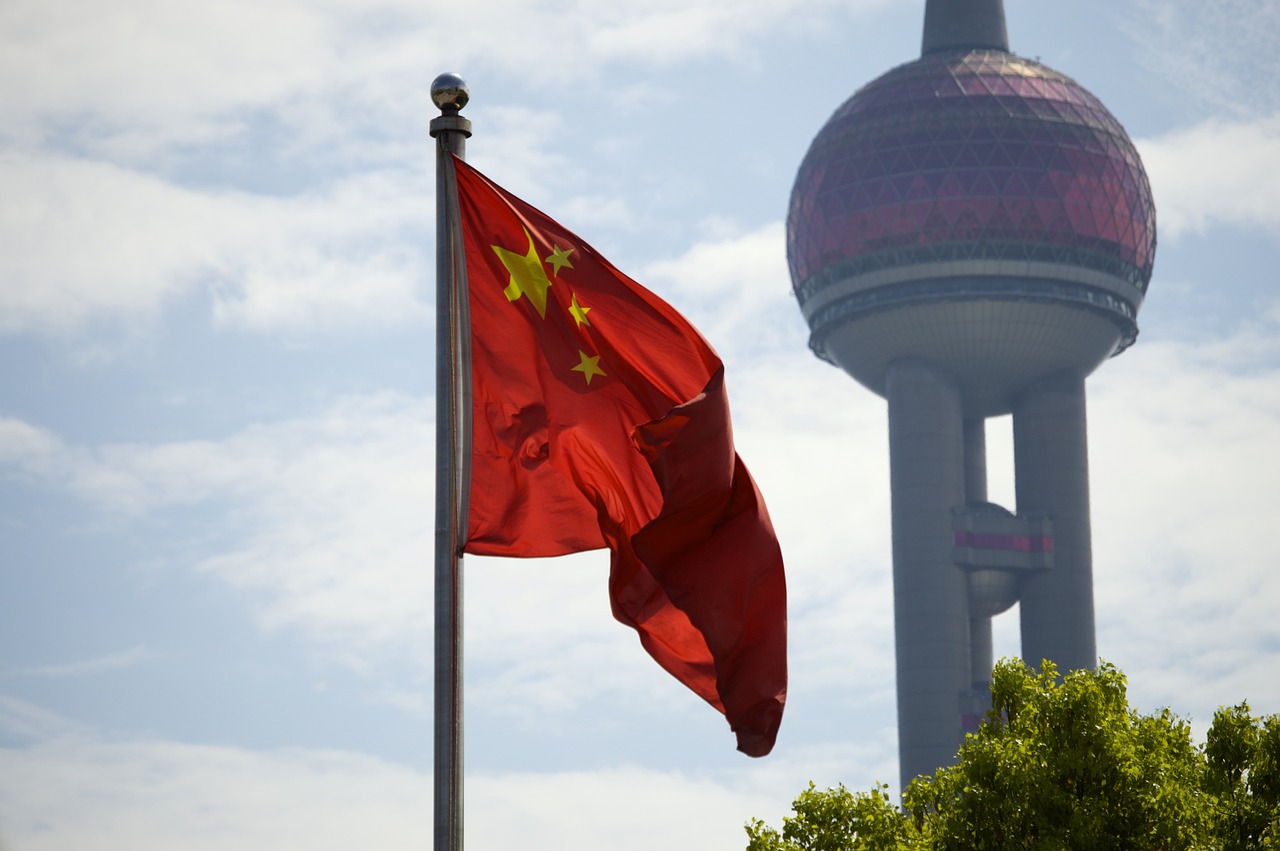

On March 31, 2016, Standard & Poor's Ratings Services revised the outlook on the People's Republic of China to negative from stable. At the same time S&P affirmed 'AA-' long-term and 'A-1+' short-term sovereign credit ratings on China. The downgrade follows a similar move by ratings agency Moody's Investor Services in early March.

S&P said that economic rebalancing in China is likely to proceed more slowly than expected and added that gradually increasing economic and financial risks to the government's creditworthiness could result in a downgrade this year or next.

The rating agency said that downgrade could ensue if we see a higher likelihood that China will seek to stabilize growth at or above 6.5% by increasing credit at a significantly faster rate than the nominal GDP growth, such that the investment ratio is above 40%. Such trends could weaken the Chinese economy's resilience to shocks, limit the government's policy options, and increase the likelihood of a sharper decline in the trend growth rate.

If, on the otherhand, the central government adopts policies to moderate credit growth at levels more in line with nominal GDP growth, accompanied by signs that rebalancing will progress more quickly than we currently expect, ratings could stabilize at this level, noted S&P.

The news is unlikely to be welcomed by Chinese officials, many of whom have publicly criticized the Moody's downgrade as baseless. The yuan currency weakened slightly in offshore markets after the S&P news but later steadied to currently trade at 6.4605 against the dollar.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data