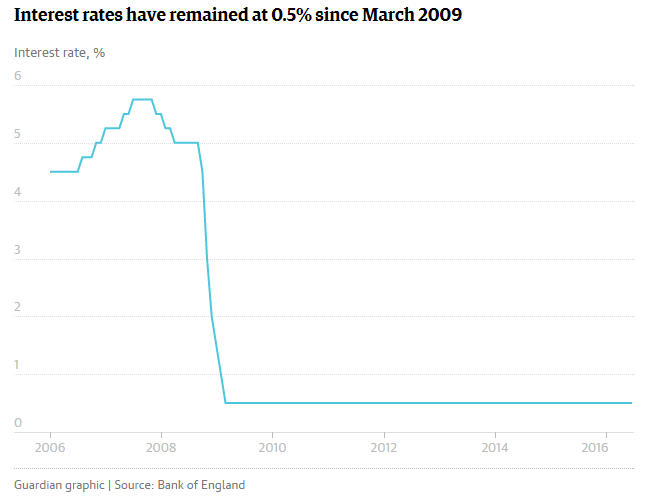

Markets await Bank of England's (BoE) policy decision on Thursday, 4th August. The BoE is likely to become the first central bank to take action in response to the referendum. Amid the heightened uncertainty, expectations are riding high that it will announce a raft of measures to support the economy. BoE will also publish latest inflation report and growth forecasts this week and markets will look closely at the inflation report to see the central bank's take on Brexit consequences.

Data released earlier on Wednesday by Markit and the Chartered Institute of Procurement & Supply showed UK's services sector, which accounts for more than 75 percent of the country's GDP, is tumbling towards a recession. The headline reading came in at 47.4 for July, confirming the flash estimates. It was the first contraction in UK services sector in more than four years. The reading also showed the sharpest decline in both output and new business in the services sector in more than seven years. Details of the report suggest significant headwinds for near-term outlook.

"At these levels, the PMI data are collectively signalling a 0.4 percent quarterly rate of decline of GDP. The unprecedented month-on-month drop in the all-sector index has undoubtedly increased the chances of the UK sliding into at least a mild recession," said Markit's chief economist, Chris Williamson.

Markets have for now fully priced in a rate cut from the central bank. Nonetheless, a rate cut accompanied by a QE response would be initially negative for the pound. However, there are cases where central banks have delivered further QE, but their currencies have subsequently rallied. The key to whether GBP weakness can be sustained is the extent of revision to the BOE forecasts and whether it leaves the door open for further policy action in the months ahead.

There is scope, given the relatively extreme short positioning, to see a re-test of 1.35 range highs. A break below the 1.3060 level will accelerate the bearish move, with 1.2945 and 1.2798 next supports. Cable trades in a narrow range as markets wary ahead of BoE policy decision. GBP/USD was slightly weaker on the day, down 0.19 percent, trading at 1.3330 at around 12:45 GMT.

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell