It’s wrong to expect a “snap-back” at shopping centres, food courts, cinemas and other places where people used to gather to spend money.

We’ve identified three reasons why spending in physical stores on goods like clothes is likely to remain much lower than it was for a long time.

1. Fear, much of it age-based

First, even when governments relax restrictions, lots of people will still be worried and will go out less. Unless there are zero cases for several weeks in a state or city, many people will remain reluctant to go out.

This is why we have previously argued that there is a big dividend in eliminating COVID-19 in the style of New Zealand, the Northern Territory, and South Australia, rather than bumping along with “suppression” – and several new locally-acquired cases a day – as Victoria is still doing.

This reluctance to go out and spend, irrespective of government restrictions, could be seen in Australia before government restrictions were imposed, as shown on the “Consumers and mobility” tab of the Grattan Econ Tracker.

The effects of fear shouldn’t be underestimated.

Spending in Sweden has fallen almost as much as in Denmark, even when Denmark was in lockdown and Sweden had minimal restrictions. Swedes are afraid to go out, particularly if they are old.

Spending by people aged 70+ has fallen further in Sweden than in Denmark, and 60-69 year-olds have cut their spending by about the same amount in both countries.

This isn’t surprising. COVID-19 is much more deadly for older people.

Age-based fear is a challenge for retailers because older households now spend significantly more than younger households. 25 years ago it was the other way around.

2. Time to form new habits

Second, we are likely to keep spending on different things, and using different channels, even after restrictions are lifted.

Habits tend to form when behaviour changes consistently. They strengthen over time, and are particularly sticky once behaviour has been consistent for a period of months – and we’ve been living with lockdown for that long in Australia.

Once formed, the new habits can persist unless there is another shock.

Australians have become used to doing more of their purchasing online. They have become used to spending more on living comfortably at home, and less on clothes for the office and to go out.

After the shutdown, people are likely to continue to work from home more often.

The habits of shopping remotely, and spending more on home furnishings and less on clothes, are likely to continue, and they would be likely to continue even if COVID-19 vanished tomorrow.

3. Global recession

Third, irrespective of COVID-19 regulations and behaviours, we are heading into an “old-fashioned”, globally synchronised, deep recession.

For the moment, JobKeeper, the temporarily-boosted JobSeeker payment, and a recent bounceback, have resulted in spending on credit and debit cards a bit more than this time last year.

But unemployment jumped to 7.1% on Thursday. That official rate understates how bad things are.

In May an extra 227,700 Australians lost their jobs (on top of 607,400 in April).

But only 85,000 of them were counted as unemployed. When and if the bulk of those people look for work, the unemployment rate will climb further.

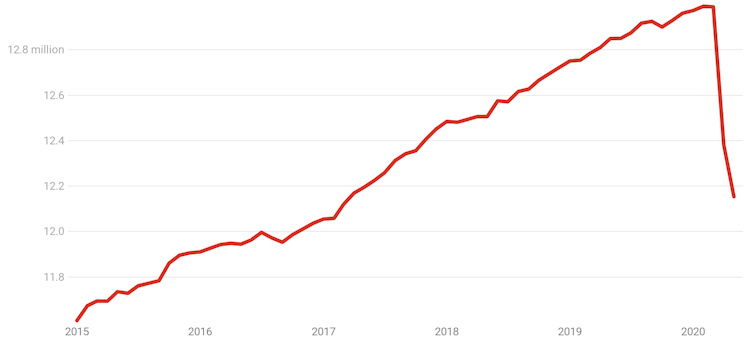

Employed Australians, total

Includes Australians regarded as still employed because they are on JobKeeper. ABS 6202.0

After JobKeeper ends in September (or is phased out as a result of the government’s review) many of the three million people on it will also become counted as unemployed.

Australians who have lost their jobs are likely to spend less than they did before.

After each of the previous two recessions it took years for employment to recover.

Spending need not recover after COVID

These three factors – fear, new habits, and recession – are present in countries and regions that seem to be well clear of coronavirus.

Much of China has been free of most government restrictions for months. Manufacturing and infrastructure spending has largely returned to pre-COVID levels.

But consumer activity is still below pre-COVID levels, and it is inching up only slowly.

Australia might well see an “opening party” on the day each particular COVID-19 restriction is lifted.

But after that, the best guess is that consumer spending will remain very subdued and refocused for a long time.

For those in the hardest-hit sectors and regions – particularly arts and recreation, hospitality, and clothing – the pain will continue long after the restrictions are lifted.

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links