Turmoil in financial markets has now spilled over third week, which began when China chose to devalue its currency using the fix. Fix is the mid-value of Dollar/Yuan, which is set by People's bank of China (PBoC) every day before market opens.

China officially devalued Yuan for three consecutive days of about 2% after which PBoC suggested there are not much scope of further devaluation.

No matter how much Chinese authorities assure the market that current move was a onetime controlled devaluation, with rate hike from US Federal Reserve looming ahead, the actual fact is it is another peg break.

Recent financial market turmoil and risk aversion can be explained with greater ease, if one assumes the idea of peg break, instead of controlled devaluation.

Why call it peg-break?

- China has no official peg with US Dollar but everyone familiar with China, Yuan and PBoC knows clearly that the rate is heavily managed. Looking at USD/CNY chart it becomes extremely clear that PBoC has maintained or at least tried to maintain the Yuan/Renminbi around 6.2 against Dollar since December last year.

- Since last Year. Outflows from China has outpaced PBoC's original assumption. In March, central bank governor said growing demand for Dollar is normal and reasonable and capital flight isn't large scale and Yuan is relatively stable.

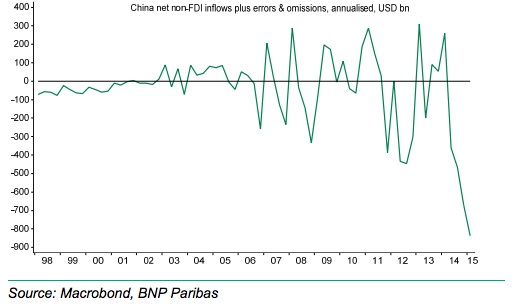

As per latest data, in past one year till first quarter, China experienced $584 billion flowing out of the economy and this year alone $209.5 billion till first quarter. The chart shared is courtesy of BNP Paribas.

Even if capital outflow remained at same level (though we hardly doubt that), PBoC has been maintaining a very costly peg and at some point it was inevitable or prudent to let the currency devalue to release some of the pressure.

However, whether the move will reduce capital flight or not is matter of anther debate, which we would revisit at later post.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate