The Biden administration is finalizing new electric vehicle tax credit rules, slashing the list of eligible models to just 13. This update, part of a broader effort to refine economic incentives before the election, significantly focuses on sourcing and geopolitical considerations, impacting several major automakers.

New Restrictions Target Battery Components, Impacting EV Eligibility and Automaker Strategies

The guidelines, proposed by the administration in December, set new restrictions on a credit of up to $7,500 per vehicle, providing a strong incentive for drivers interested in electric cars but put off by their high cost. According to Bloomberg, the restrictions prohibit tax benefits for automobiles containing battery components or crucial minerals from "foreign entities of concern" – government jargon for corporations owned by US geopolitical enemies like China.

Automakers like Tesla Inc., General Motors Co., and Toyota Motor Corp. lobbied hard on the standards. Even in their planned form, they have had an impact. The restriction on battery components took effect on January 1 and significantly reduced the number of vehicle models eligible for the tax credit. The critical mineral restriction is set to take effect in 2025.

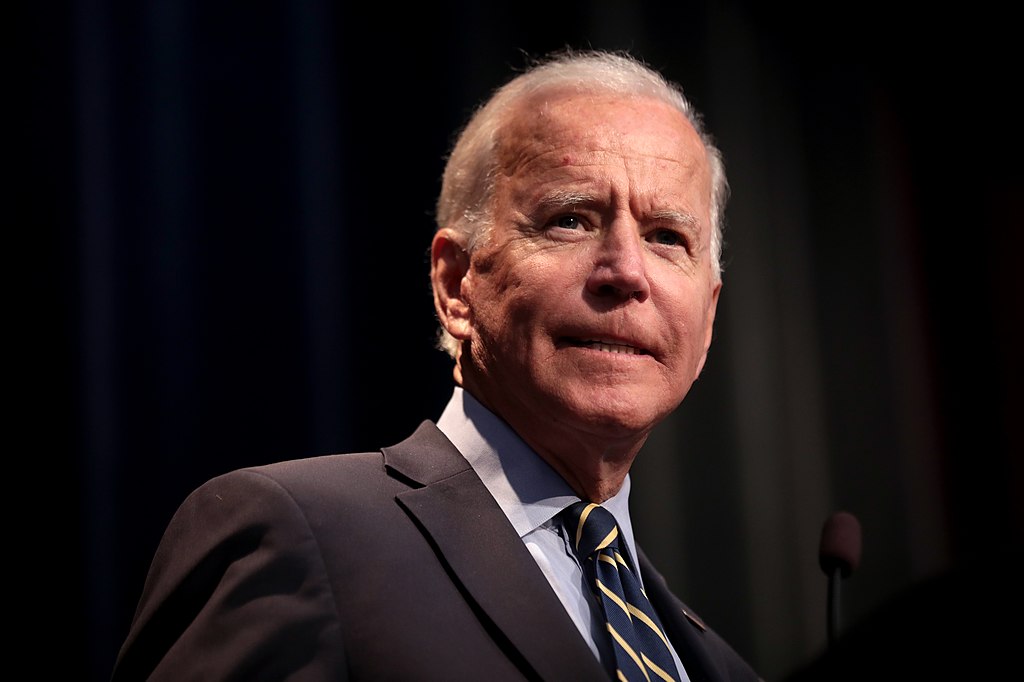

The decision comes as the deadline for finalizing regulations to make them less vulnerable to repeal if President Joe Biden loses reelection in November expires before the summer.

Stricter EV Tax Credit Standards Slash Eligible Models, Prompt Automaker Supply Chain Adjustments

Early this year, reports show that the number of electric vehicle models qualifying for a $7,500 consumer tax credit reduced substantially after the new Biden administration guidelines took effect on January 1.

According to federal data from fueleconomy.gov, narrower requirements reduced the number of qualifying models to 13, down from approximately two dozen. Under the new standards, vehicles with battery components manufactured in China are not eligible for tax credits.

Treasury Department spokesperson Ashley Schapitl stated that the government has collaborated closely with corporations on the new limits. However, some companies have yet to submit data, which may result in additional data being added to the list.

"Automakers are adjusting their supply chains to ensure buyers continue to be eligible for the new clean vehicle credit, partnering with allies and bringing jobs and investment back to the United States," she said.

Treasury Department restrictions issued last month target battery components manufactured by any company subject to Chinese jurisdiction or owned at least 25% by the Chinese government. In 2025, the limits will be extended to encompass suppliers of critical raw materials for batteries, such as nickel and lithium.

Depending on the location of the battery component and part production, automobiles may be eligible for a $7,500 or $3,750 tax credit.

The Tesla Model Y, Rivian Automotive's R1T pickup truck, Stellantis' Jeep Wrangler 4xe, and Ford's F-150 Lightning pickup truck are among the vehicles that remain eligible for full or partial consumer financing.

Models that lost access to credit included Tesla's Cybertruck and some variants of its Model 3, Nissan's Leaf, Ford's E-Transit van, and General Motors' electric Blazer and Silverado.

The new criteria were inserted into President Biden's flagship climate measure at the request of Sen. Joe Manchin III, the West Virginia Democrat who voted on the Inflation Reduction Act. Manchin expressed concern that American taxpayers were supporting batteries made in China.

Photo: Gage Skidmore from Peoria, AZ, United States of America, CC BY-SA 2.0, via Wikimedia Commons

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Supreme Court Signals Skepticism Toward Hawaii Handgun Carry Law

Supreme Court Signals Skepticism Toward Hawaii Handgun Carry Law  Federal Judge Rules Trump Administration Unlawfully Halted EV Charger Funding

Federal Judge Rules Trump Administration Unlawfully Halted EV Charger Funding  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Federal Judge Blocks Trump Administration Move to End TPS for Haitian Immigrants

Federal Judge Blocks Trump Administration Move to End TPS for Haitian Immigrants  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Court Allows Expert Testimony Linking Johnson & Johnson Talc Products to Ovarian Cancer

Court Allows Expert Testimony Linking Johnson & Johnson Talc Products to Ovarian Cancer  U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday

U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday  Panama Supreme Court Voids CK Hutchison Port Concessions, Raising Geopolitical and Trade Concerns

Panama Supreme Court Voids CK Hutchison Port Concessions, Raising Geopolitical and Trade Concerns  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  US Judge Rejects $2.36B Penalty Bid Against Google in Privacy Data Case

US Judge Rejects $2.36B Penalty Bid Against Google in Privacy Data Case