Chinese stock market crash after rising more than 150% and Yuan devaluation have rattled global markets highlighting China's importance in world economy today, however these issues are really not China's problem but can be called as offshoots.

The real problem of China, is its economy, which is slowing down at considerable pace.

While optimists believe that China's economy might be turning corner, we at FxWirePro think current evidence may not point to immediate (next three months) hard landing but still not sufficient to signal a turn around.

Views from senior official from China's steel association suggests, that the crisis may not be over. According to him, China's steel production is going down and what is more alarming is that demand is falling faster.

Why China's growth might falter further?

One of the key reason is China's over dependence on Capital for growth.

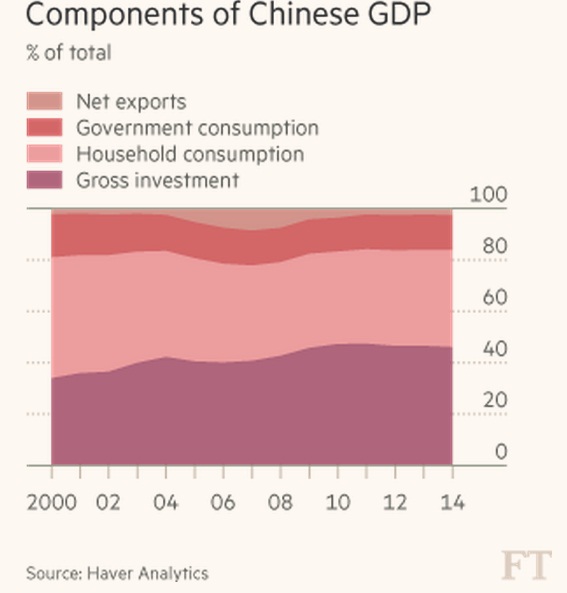

Research from Haver Analytics point out contributions of components to China's GDP growth as shown in the figure. As of latest, gross investment still contribute to more than 40% to China's GDP, almost equivalent to household consumption. And way more than less than 20% contribution from net exports and government consumption combined.

However latest figure of investments, such as FDI, urban investments all pointing to lower capital formation in Chinese economy. October's urban investment data showed growth has fallen to 10.2% from around 25% growth back in 2011. Similarly FDI YTD growth till October has slumped to just 8.6% compared to close to 30%, back in 2011.

It is quite evidently clear, that China's investment engine is faltering.

Faltering investment means lower growth for China, which in turn means lower return, leading to lower growth-investment spiral, unless the economy is able to break it.

Chart courtesy, Haver Analytics, Financial Times and Martin Wolf. For similar read check out Martin Wolf's excellent piece @ https://next.ft.com/content/cfe855be-5092-11e5-8642-453585f2cfcd.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?