There are great extent of debates going among economists, analysts and market participants over whether Yuan will get devalued significantly in 2016 or not.

Those favoring devaluation arguments, suggesting, Yuan will get devalued significantly (greater than 6%) in 2016 as it is in China's interest to devalue the Yuan to improve upon its falling exports. Moreover, PBoC will increase policy accommodation further in 2016, which would be Yuan negative at a time when FED reserve will hike rates further. China's high corporate debt and declining reserve will add to the mix.

Others suggest, despite lessening grip over Yuan's movement, PBoC would nevertheless would manage with an iron fist and improvement in global growth would improve China's export and economic outlook in 2016. Lower commodity prices including energy, would boost China's domestic consumption significantly. They expect, Yuan to go through more controlled depreciation, lower than 5% and in line with this year's 4% decline.

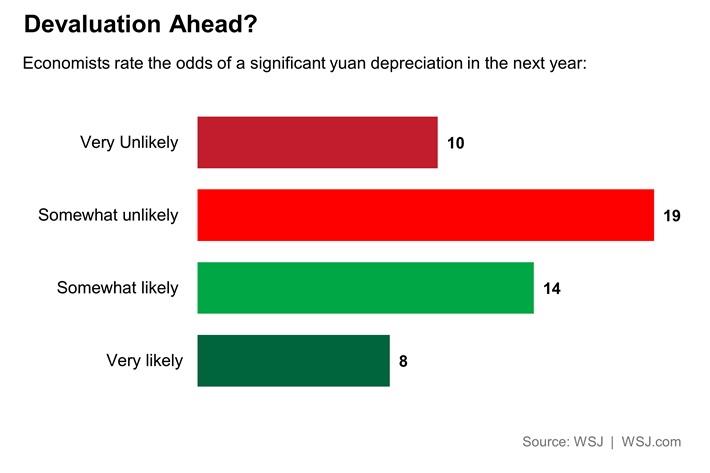

According to result, poll conducted by Wall Street Journal (WSJ), only 43% of economists think significant devaluation is likely, while about 16% think it's very likely, compared to 20% considering it to be very much unlikely.

Yuan is down for seventh consecutive day today, trading at 6.468 per Dollar.

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure