Minutes of the Reserve Bank of Australia's (RBA) November 1 meeting where the bank left the cash rate unchanged at a record-low 1.5 percent were released earlier on Tuesday. In its minutes the RBA said that the risks to the global inflation outlook "were more balanced than they had been for some time". The RBA noted that assessing conditions in the housing market had become more complicated.

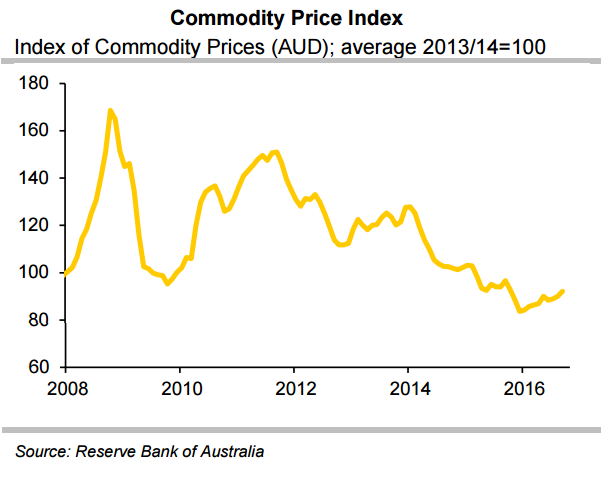

Australia is currently enjoying a windfall as key commodity prices surge, lifting the nation's terms of trade and boosting national income. This is symbolized by the Australian terms of trade that have risen for the first time in two years in Q2. That said, the RBA may likely to look through the recent spike in commodity prices given at least some of the strength is likely to be temporary, although the Bank is likely to be more confident that national income growth is now on an upward trajectory.

November minutes highlighted a number of areas of uncertainty facing the outlook. These included the outlook for the terms of trade and for the Chinese economy. Domestically, there was uncertainty about the outlook for consumer spending and the amount of spare capacity within the labour market. A further rate cut from the RBA is hence less likely in the coming months.

The RBA remains cautious and will closely monitor the labour market in the future. Wage developments remain one of the most important risk factors for its inflation outlook. Australia is struggling with weak inflation which is expected to reach the bottom of RBA's 2 to 3 percent target at the end of 2018. While unemployment has fallen, most of the jobs growth has come from part-time work and the jobless rate of 5.6 percent is dented by falling participation.

"The RBA’s relatively upbeat stance suggests that further rate cuts are unlikely in coming months, unless incoming data diverges significantly from its forecasts. However, in our view, the downside risks to the RBA’s growth and inflation forecasts continue to suggest that further monetary easing will be on the cards over 2017," said St George Economics in a report to clients.

AUD/USD was trading at 0.7554 at around 1220 GMT. FxWirePro's Hourly Australian Dollar Strength Index stood at 14.8167 (neutral), while Hourly USD Strength Index stood at 112.449 (highly bullish). For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal