The Reserve Bank of Australia (RBA) holds its policy meeting on Tuesday and is considered almost certain to keep rates steady, at an all-time low of 2.0 percent. A lot has happened since the RBA's August meeting, raising concerns about downside risks to the outlook. To a large extent these risks emanate from China.

There is nothing in the latest set of economic reports that would push the RBA to cut interest rates on Tuesday. Growth in Australia's investor mortgage credit cooled to its slowest in nearly two years in July. Other data out on Monday was mixed, with weak business inventories offset by a solid bounce in wage incomes, leaving intact forecasts for a soft gross domestic product figure (GDP) for the second quarter. The GDP data is due on Wednesday.

"The generally reasonably upbeat flow of economic activity data is expected to be confirmed in the Q2 GDP report the day after the policy meeting - no doubt the RBA's staff will have a good estimate as to what the outcome will be", notes Societe Generale.

Also the shift in China's exchange rate regime has added to the uncertainty in various ways: most directly by reducing the purchasing power of the Renminbi. It has also had a depressing effect on the currencies of other regional economies, exacerbating downward pressures on their purchasing power, which in turn will probably hurt their demand for commodities. At the margin, all this is bad news for Australia. That said, one saving grace is that AUD itself has not appreciated against the RMB which is good news for Australia's fairly important service export sector.

The bottom line is that the RBA board's view is likely to have shifted from the rather benign assessment of the August meeting which the minutes described as follows: "Members observed that the downside risks to the outlook for Chinese growth identified over the past year had receded somewhat".

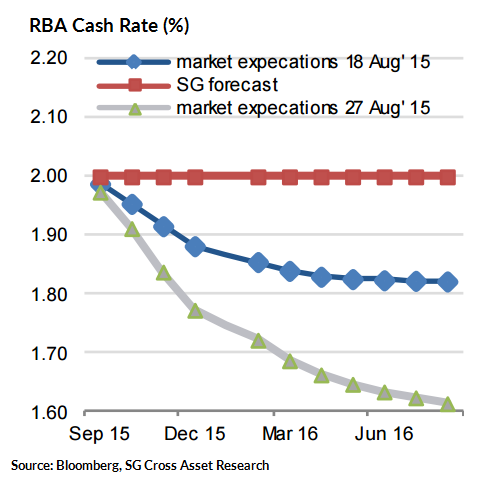

"Despite increased economic uncertainty about China and Asia in general, adding to doubts about the timing of the US Fed's first rate hike, we believe the chance of a policy reaction from the RBA at this stage is minimal (say, 10%)", says Societe Generale in research note to its clients on Monday.

The Australian dollar fell on Monday weighed down by a diverging interest rate outlook compared with the United States and concerns about the health of China's economy. AUD was down at $0.7136, from $0.7175 in New York on Friday.

RBA confronts riskier outlook, unchanged policy rate most likely outcome

Monday, August 31, 2015 10:50 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?