The pound has been holding up pretty well for the past few weeks, against the dollar. Today, a better than expected GDP flash reading could improve the mood. The data has quite a potential to surprise on the upside, just like other figures. Citi’s economic surprise index, based on the UK data has reached the highest level in almost three years. The economy has turned out better than expected after the referendum than the economists have forecasted.

However, Today’s figure may not be a major booster for the UK assets, even if it turns out better than expected, especially since the figure if of the second quarter, which is before the referendum.

Today’s release is the second flash estimate of second quarter GDP.

Past trends –

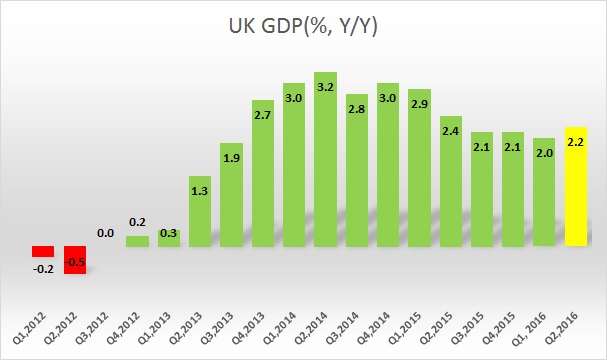

- After the 2008/09 crisis, the UK economy has been growing at the fastest pace among its OECD peers.

- GDP growth reached the highest level in the second quarter of 2014, reaching 3.2 percent growth on a yearly basis. Since then growth has somewhat waned. In last quarter of last year, growth was 2.1 percent y/y, same as the third.

- This year, the economy grew 0.4 percent in the first quarter and first flash estimate shows it to be growing by 0.6 percent in the second quarter on a quarterly basis.

Expectations today –

- Today, GDP growth is expected at 0.6 percent q/q and 2.2 percent y/y. The important thing to watch out would be whether the month of June, when the referendum was held made a difference or not.

Impact –

- The pound is currently trading at 1.323 against the dollar and a better data might help the pair (GBP/USD) to test resistance around 1.327, however, the market is focused on the speech of Fed chair Janet Yellen from Jackson Hole today.

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX