The Swiss National Bank delivered its monetary policy announcement on Sept 17th, where it left the policy mix unchanged as broadly expected, in an effort to rein in the Swiss franc, which it said remained "significantly overvalued". The bank maintained the -1.25 to -0.25 percent range for the 3-month Libor as well as the -0.75 percent setting for the sight deposit rate.

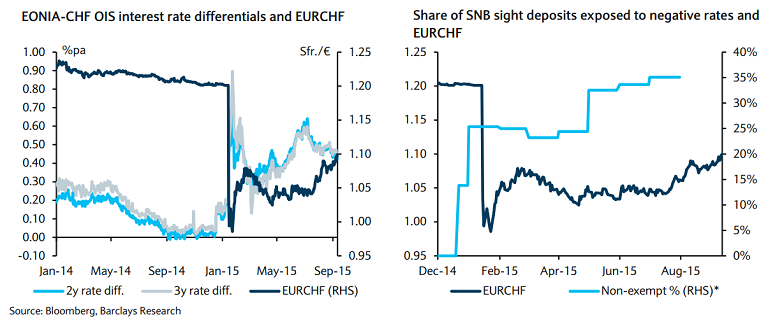

It is worth noting that the SNB in its policy statement made no mention of the latest dovish turn in ECB rhetoric and the possibility for stimulus expansion it implied. Analysts also expect that the ECB's extention of the time horizon of its QE would not add great pressure on the EUR/CHF as narrowing EONIA-CHF swap rate differentials would likely come back to their July levels.

Further, analysts expect CHF rates to fall as well, as markets would expect the SNB's negative nominal rates policy to be retained longer in tandem with ECB policy. A mild EUR/CHF appreciation is expected in the coming quarters, as the SNB's policy of negative nominal rates appears to be facilitating EUR/CHF appreciation.

"We forecast EUR/CHF to rise to 1.10 by year-end and appreciate towards 1.13 by Q3 16", says Barclays in a note to its clients.

As of now, the SNB is expected to adopt a 'wait-and-see policy,' rather than respond with immediate action to an extension of the ECB's commitment to QE. In contrast, a cut in the ECB's deposit rate further would likely have a significant effect on the EUR/CHF exchange rate and provoke a more immediate response from the SNB, including removing all exemptions of domestic banks on sight deposits at the SNB.

SNB is likely to be concerned about the path of ECB policy. Further ECB easing may disrupt the recent trend of EUR/CHF appreciation, but unlike the SNB's pre-emptive decision to abandon the EUR/CHF floor in January, the SNB is expected to wait and see the form of any ECB policy move and its effect on EUR/CHF before acting.

"If EUR/CHF begins to reverse its trend of appreciation, the SNB might cut its deposit rate further. If, however, EUR/CHF is stable or continues to appreciate, we would expect no further action from the SNB", notes Barclays.

Bid tone on the safe haven CHF remained strong on the day as major stock futures in Europe showed signs of nervous investor sentiment. EUR/CHF was trading at 1.0927, while USD/CHF was at 0.9727 at 1100 GMT.

Path of ECB policy a likely worry for SNB

Thursday, September 24, 2015 11:13 AM UTC

Editor's Picks

- Market Data

Most Popular

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary