China stepped up its efforts further overnight to stop the CNY and CNH depreciation. On Monday, the central bank announced a new move to impose the reserve requirement ratio on some foreign banks from January 25, which would add costs for speculators on short-selling the yuan. The measure will drain an estimated CNY220bn, according to estimates cited by Bloomberg.

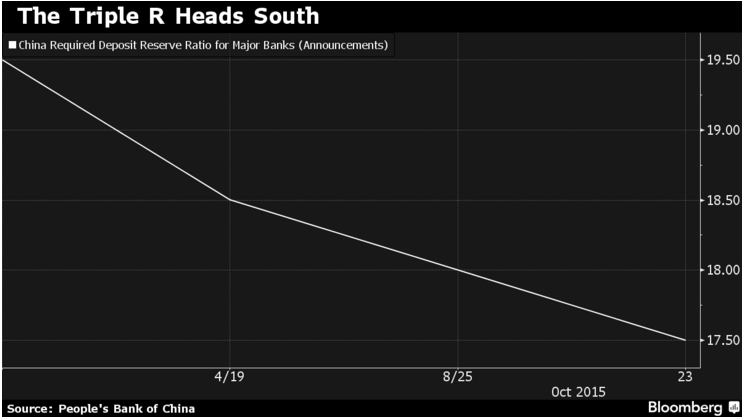

The required reserve ratio varies for Chinese lenders, and PBOC started to include mainland yuan deposits of offshore participant banks in reserve requirements last year. It was decided in December 2014, but that the ratio was set at zero temporarily to allow for preparation. It is no coincidence that the PBoC is 'normalising' the RRR now. Previously used to moderate market liquidity, RRR rate is now a tool to enforce financial stability. The RRR rate will this year fall to 15 percent from 17.5 percent for major banks, according to the median estimate in a Bloomberg survey.

"The RRR that China intends to impose on offshore CNY bank accounts will probably deter speculation against the offshore yuan (CNH) for now. Moreover, the weighted RMB index is around the floor of its stable band. This suggests that both the onshore CNY and offshore CNH have scope to remain stable even if the basket of currencies depreciates," notes DBS in a report.

Pressure on the currency, stocks, capital outflows and growth is intensifying as the PBoC struggles with the transition towards a greater role for markets. Compounding the challenge, are an overhaul of the central bank's tool kit as monetary policy shifts to a price-based mechanism and the main liquidity lever is set to be used to enforce financial stability instead.

The PBoC earlier today set the yuan's mid-point fix against the US dollar at 6.5596, 6 basis points weaker than Monday. The spot market opened at 6.5775 per dollar and was trading at 6.5796 at midday. The offshore yuan weakened 100 pips during the morning to 6.5960, nearly 0.3 percent drifting from the onshore rate.

PBoC determined to stop further CNY and CNH depreciation, RRR no likely coincidence

Tuesday, January 19, 2016 11:53 AM UTC

Editor's Picks

- Market Data

Most Popular

3

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand