NVIDIA Corporation (NASDAQ: NVDA) used the CES 2026 convention in Las Vegas to reaffirm its leadership in artificial intelligence infrastructure, announcing that its next-generation Rubin data center platform is now in full production and on track for release later this year. The move highlights Nvidia’s accelerated release cycle as competition intensifies from rivals such as Advanced Micro Devices (NASDAQ: AMD) and custom silicon developed by major cloud providers.

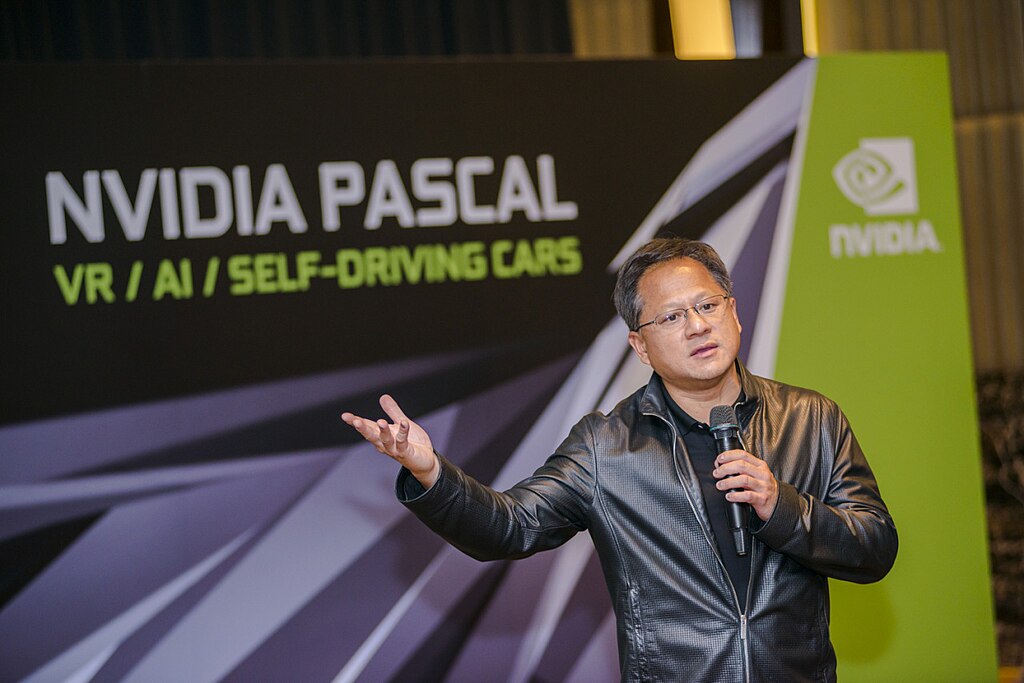

During his keynote address, CEO Jensen Huang revealed that all six chips in the Rubin platform have successfully returned from manufacturing partners and passed initial milestone tests. This puts the new AI accelerator systems on schedule for customer deployments in the second half of 2026. By unveiling Rubin early, Nvidia is signaling confidence in its roadmap while keeping enterprises closely aligned with its hardware ecosystem.

The Rubin GPU is designed to meet the growing demands of agentic AI models, which rely on multistep reasoning rather than simple pattern recognition. According to Nvidia, Rubin delivers 3.5 times faster AI training performance and up to 5 times higher inference performance compared to the current Blackwell architecture. The platform also introduces the new Vera CPU, featuring 88 custom cores and offering double the performance of its predecessor. Nvidia says Rubin-based systems can achieve the same results as Blackwell while using far fewer components, reducing cost per token by as much as tenfold.

Positioned as a modular “AI factory” or “supercomputer in a box,” the Rubin platform integrates the BlueField-4 DPU, which manages AI-native storage and long-term context memory. This design improves power efficiency by up to five times, a critical factor for hyperscale data centers. Early adopters include Microsoft (NASDAQ: MSFT), Amazon AWS (NASDAQ: AMZN), Google Cloud (NASDAQ: GOOGL), and Oracle Cloud Infrastructure (NYSE: ORCL).

Beyond data centers, Nvidia also highlighted major advances in robotics and autonomous vehicles, calling the current period a “ChatGPT moment” for physical AI. New offerings such as Alpamayo AI models for self-driving systems and the Jetson T4000 robotics module further underscore Nvidia’s bet that reasoning-based AI will drive a massive, trillion-dollar infrastructure upgrade across industries.

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services

Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers

SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers

SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns