The Executive Board of the Norges Bank kept its policy rate unchanged at 0.50 percent at its March policy meeting as economists had forecast. Norges Bank has maintained the highest key rate of any major European central bank, but cooling inflation in recent months had prompted warnings that it could cut rates. Policymakers said capacity utilization is below a normal level, and inflation is likely to range between 1 percent and 2 percent in the coming years.

Data published by Statistics Norway showed Monday that Norway's inflation slowed slightly in March, dragged by sharp fall in airfares. Norway's consumer price inflation came in at 2.4 percent in March slower than 2.5 percent in February. A large part of the decline in February was due to air fares, which were expected to normalize in March.

Sharp fall in airfares continued to be the most important drag which weighed on the increase in consumer prices. Prices of electricity surged 15.5 percent annually and food prices gained 2.8 percent, while airfares fell 24.4 percent. Month-on-month, consumer prices moved up 0.3 percent. Data showed that core inflation rose slightly to 1.7 percent in March from 1.6 percent in February. EU harmonized inflation edged lower to 2.5 percent from 2.7 percent in the prior month.

Producer price inflation (PPI) slowed to 16.1 percent in March. Despite the slowdown, Norway PPI still remained at an elevated level. The fall in PPI in March compared to 18.8 percent advance in February. Month-on-month, producer prices dropped 1 percent reversing a 2.7 percent rise in February. This was the first fall in six months.

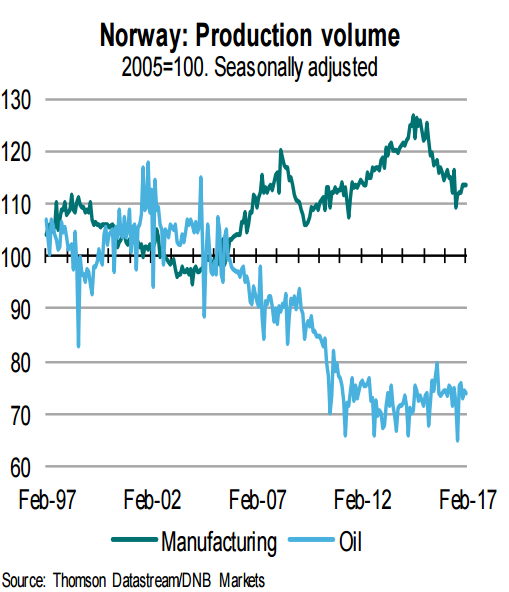

Norway's manufacturing production remained unchanged m/m in February, as expected by consensus. Production in intermediate goods (-2.2 percent) and energy fell in February, while capital and consumer goods saw a modest increase in production. Policymakers judged that there is a continued need for an expansionary monetary policy to support structural adjustments in the Norwegian economy.

"After a long period with a sharp fall in manufacturing production in the aftermath of the oil price fall , the outlook is improving. We expect a slow upturn in the Norwegian economy, which is consistent with a slow uptick in manufacturing production going forward." said BNB Bank in a report.

USD/NOK was trading at 8.6458, while EUR/NOK was trading at 9.1441 at around 1210 GMT. FxWirePro's Hourly USD Spot Index was at 114.271 (Bullish), while Hourly EUR Spot Index was at -81.1396 (Bearish) at the same time. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence