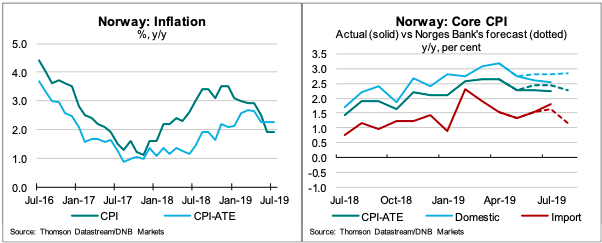

Norway’s core inflation came in path at the September meeting. However, the inflation outlook is not expected to be decisive for if Norges Bank will commit to a September hike at the meeting next week or not.

The weakness in growth among Norway’s trading partners and the escalation of the trade war make markets expect Norges Bank to signal a more cautious stance at the meeting next week (read our preview here).

"We still believe Norges Bank will repeat the sentence “…the policy rate will most likely be increased further in the course of 2019”, but no longer single out September as the most likely meeting for the next hike," DNB Markets reported.

"We expect the hike to be postponed to December. Core inflation (CPI-ATE) was 2.2 percent y/y in July, down from 2.3 percent in June," the report added.

Core inflation only fell by 0.01 percentage-point from 2.258 percent to 2.245 percent. Consensus expected 2.2 percent, according to Bloomberg and Norges Bank projected 2.4 percent in the June MPR. Prices on imported goods rose by 1.8 percent y/y in July, up from 1.5 percent y/y in June.

Other core prices rose by 2.5 percent y/y in July, unchanged from June. (Due to rounding it seems like there is inconsistency between the core inflation number and import and domestic inflation).

Meanwhile, the total consumer price index rose by 1.9 percent y/y in July, unchanged from June. Bloomberg Consensus expected 1.8 percent, Norges Bank forecasted 1.8 percent, vs expectations of 1.7 percent. EUR/NOK fell approximately 2 percent after the release.

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal