After delivering a comprehensive package of policy easing measures in August, the Bank of England is widely expected to stay pat at its September policy meeting scheduled next week. Focus is likely to be on the wording in the minutes which are released alongside the decision.

August minutes noted that 'If the incoming data proved broadly consistent with the August Inflation Report forecast, a majority of members expected to support a further cut in Bank Rate to its effective lower bound at one of the MPC’s forthcoming meetings during the course of the year.' And any change in the wordings could provide clues to gauge how likely it is that the Bank will loosen monetary policy further at the November meeting or beyond.

To a large extent incoming data have been broadly consistent with the Bank’s latest forecasts. Bank of England Governor Mark Carney on Wednesday defended the central bank's decision to launch stimulus efforts in the wake of the Brexit vote. "I absolutely feel comfortable in the decision that I supported and the committee took in August to supply monetary policy stimulus," he told members of the Treasury Select Committee in London.

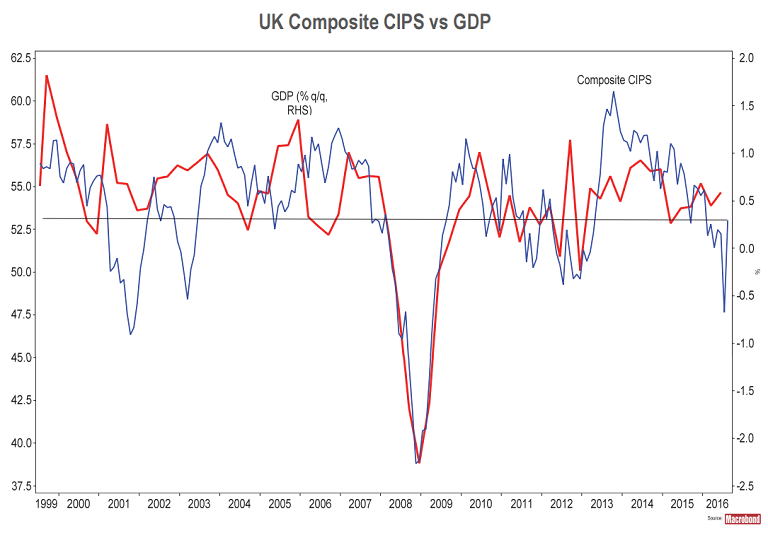

A recent round of U.K. economic data have come in stronger than anticipated. Carney also said the risk of recession for the British economy has been reduced compared with before the June 23 referendum in which the majority of U.K. voters showed support for the country leaving the European Union. Bank’s GDP projection had assumed that the PMI surveys would bounce back. After nose-diving in what was a shock in the aftermath of the Brexit vote, PMI surveys have more than recovered those losses in August. Outcome of Q3 GDP which will be released on 27 October will be crucial.

Bank of England's survey showed earlier on Friday that the proportion of British people who think the Bank of England will raise interest rates over the next year has plunged to record low. The report showed 21 percent of people surveyed in August expected the central bank to raise rates in the next 12 months, down from 41 percent in May, the lowest level since the survey began in 1999. Nineteen percent of respondents thought the BoE would cut rates in the coming year, up from just 5 percent in May and the highest level since November 2008.

Cable higher on the day after upbeat UK data releases. GBP/USD hovering around 1.33 handle, while EUR/GBP at 0.8461 at around 12:00 GMT.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic