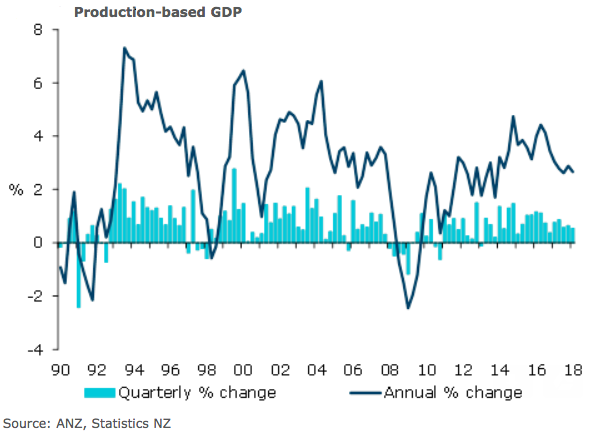

New Zealand’s economy expanded by 0.5 percent in the first quarter of this year, meeting market expectations, although the underlying momentum remained softer and this is expected to continue through the middle of the year.

The economy is growing a bit below trend and it is expected to struggle to achieve strong rates of growth from here. This is of relevance for the Reserve Bank of New Zealand (RBNZ). The outlook for core inflation is by no means assured; in the current climate interest rates will remain on hold for some time yet, according to the latest report from ANZ Research.

On the production side, 13 of the 16 industries recorded stronger levels of activity. As expected, the services sector made the strongest contribution to growth, rising 0.6 percent with broad based gains across all 11 services industries. Primary industries partially recovered driven by increased milk production, increasing 0.6 percent after falling 2.6 percent in Q4. Goods-production was flat, with an increase in manufacturing offsetting a fall in construction activity.

Consumption was flat in the quarter (3.8. percent y/y), despite strong population growth. While this soft print follows strong growth (1.2 percent) in Q1, it is consistent with the moderation in household sentiment and spending growth in the year to date. Consumption has been growing consistently since September 2012, driven in part by strong population growth. But today we saw a fall in per capita terms. Government consumption increased 0.5 percent q/q.

Gross fixed capital investment increased 0.7 percent q/q (3.9 percent y/y). Plant and machinery investment was up 2.1 percent, reaching annual growth of 13 percent. This more than offset declines in residential, non-residential and other construction. Investment can be volatile, but this is a respectable increase in the context of the challenges the economy is grappling with.

Meanwhile, it remains to be seen whether the moderation in business activity expectations and investment intentions flows through to investment in coming quarters. Inventories made a positive contribution to growth.

"The economy is in the midst of headwinds, but it is also flexible and resilient. We are not seeing the sort of imbalances (especially external imbalances) that have often been the catalyst to tip the cycle over in the past. We expect that the economy will grow at or below trend over the next few years, supported by strong income growth (in large part a result of elevated export prices) and fiscal expansion," the report added.

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom