Bank of Japan's (BOJ) introduction of negative rates having undesired consequences across financial markets and beyond. It is more likely Bank of Japan (BOJ) policymakers will be keeping a watchful eye over the developments.

Under this series, we previously reported that small vaults are in fashion these days, despite the fact small depositors are yet to face charges for keeping money in the banks. However this trend points out that scope of negative rates remain limited in Japan. It will work till the time combined cost of physical storage, transferability and insurance is higher than negative rates.

Another trend is that government is being able to finance long term at negative rates, which probably wouldn't have been the case without BOJ's QQE and negative rates. The trend is alarming as it doesn't fit inflationary expectations and the line is probably getting diluted between easing and monetary financing.

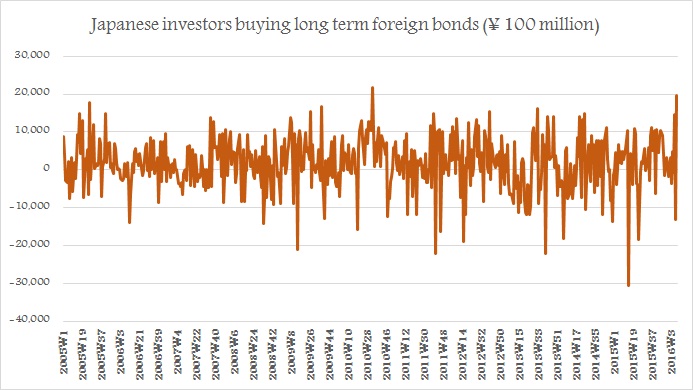

Now another trend is emerging. Japanese investors are being scared of negative rates. Japanese investors according to latest data available for January bough foreign long term debt securities at fastest pace since 2010. In 3rd week of January, investors bought net ¥1.97 trillion worth of foreign long term bonds.

Economists and analysts are getting increasing worried over negative rates and its consequences over economic structure and investor psyche.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX