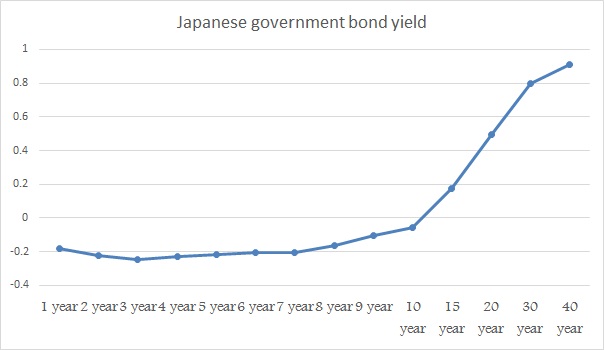

Bank of Japan's (BOJ) negative rates policy is working fine, when it comes to Japanese government bond market. Japanese government bond yields are now trading up to 10 years in negative territory. 10 year yield is currently at -0.06%. Bank of Japan (BOJ) in its last monetary policy meeting introduced, three tiered deposit rates, and one of that rate is -0.1%. BOJ governor Kuroda has promised to more as and when needed.

Today, Japan's government hit yet another milestone in terms of negative rates, achieved only by Switzerland so far. It auction longer term bond in negative for first time in history. Sheer size of the auction indicates, tremendous appetite for savings instruments, even in negative rates.

Today at auction ¥2.188 trillion ($19.45 billion) worth of 10 year bond were sold at average yield of -0.024%.

Key factors contributing to demand -

- Better deal for banks, which can park money at -0.24%, rather than -0.1%. Moreover these bonds can be sold at better rate to BOJ as it keep up purchasing bonds via its Qualitative and Quantitative Easing (QQE) program.

- Savings glut across world also contributing to the purchase of these fixed income instruments.

- Risk aversion and decline in equities leading to investors parking money into fixed income/loss.

Yen on the other hand is taking cues from risk aversion and strength of Dollar. Yen is currently trading at 113.2 per Dollar.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022