Is it BOJ or run to safety?

Doesn't matter. Bank of Japan's bid to flatten yield curve is turning out to be huge success but Yen and Nikkei are not at levels of their desire.

Nikkei cash is down more than 5% today, and that brings the index down more than 15%, so far this year. Nikkei is currently trading at 16085.

Yen on the other hand becoming Japanese policymakers' nightmare, with its sharp gain against all of major trading counterparts. Yen is trading at 114.8 against Dollar, up 4.5% so far this year and more than 7.5% in past six months.

Today, 10 year JGB has fallen to negative territory for first time. It was trading at 0.045% on Monday and today it is at -0.01%, ready to dive more. 5 year yield is down further to -0.22%.

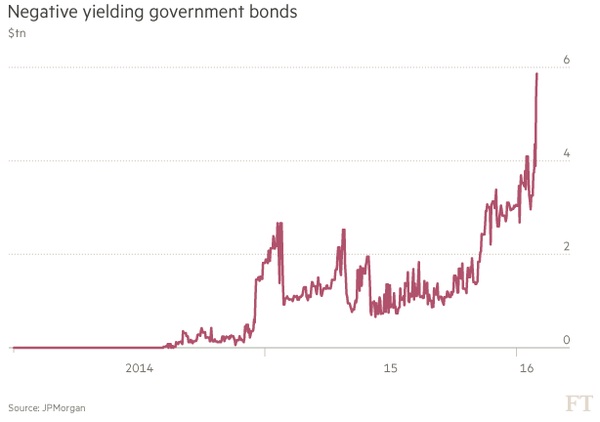

Few days back JPMorgan pointed out that negative yielding bonds are becoming an asset class of its own. According to JP's calculations few days back, more than $5 trillion worth of bonds are trading in negative yield territory.

Expect that number to jump above $6 trillion with 10 year JGB joining in.

Chart courtesy: JPMorgan, Financial Times and Soberlook.com.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom