CWIF is a meme coin with no intrinsic value or expectation of financial return. There is no formal team or roadmap. The coin is for entertainment purposes only and mostly distributed meme coin to ever exist in Solana.

Solana introduced its auto-burn feature for projects in 2023, and shortly afterward, $CWIF was introduced to the Solana meme scene. For every auto burn 4% burn fee is applicable. The auto-burn feature was created as a deflationary measure to reduce the supply of $CWIF over time.

The Official $CWIF Contract Address

7atgF8KQo4wJrD5ATGX7t1V2zVvykPJbFfNeVf1icFv1

Catwifhat $CWIF is available on a variety of DEXes (decentralized exchanges) in the Solana ecosystem. 10+ centralized exchanges (CEXes) have listed $CWIF.

CWIF vs other meme coins

CWIF- needs 4% auto burn per on-chain transaction. It has completed the biggest airdrop in Solana history with 1.6 million holders. These 1.6 million air drops were distributed to over 100 different Solana communities including meme coins, decentralized physical infrastructure projects, governance coins, and NFT.

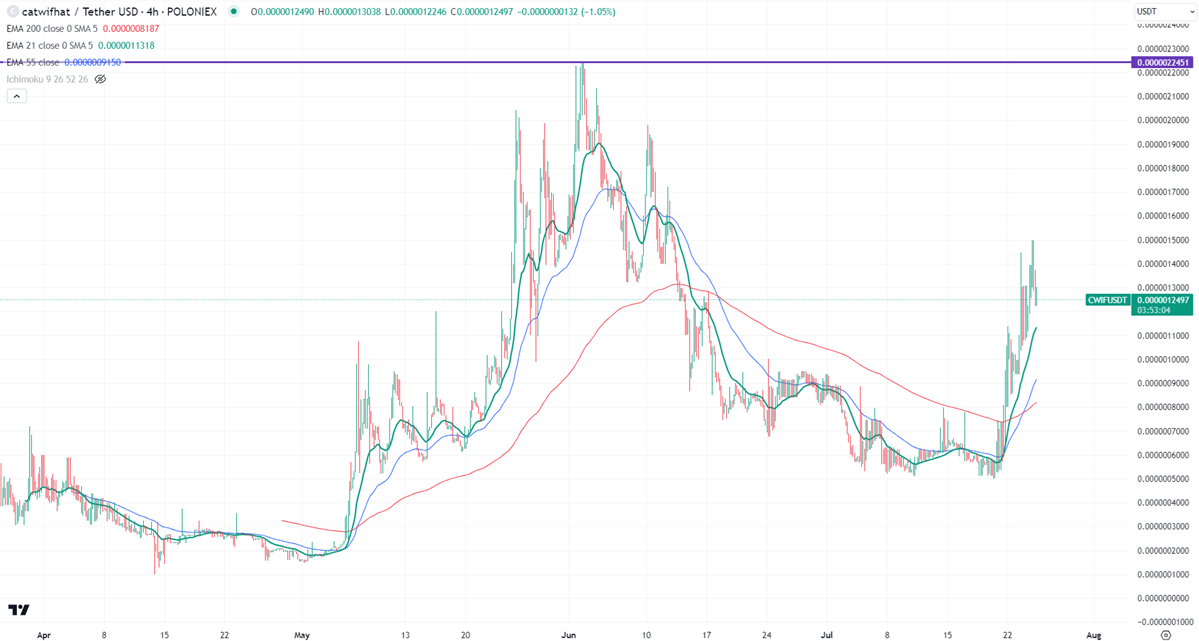

CWIFUSD trades higher after a massive sell-off.

Any daily close above $0.00000225 confirms further bullishness.

CWIFUSD gained more than 150% in the past five days. The pair holds well above the short-term (21 and 55 EMA) and long-term moving average. It hit a high of $0.0000014955 and is currently trading around $0.0000012490.

The bullish invalidation can happen if the pair closes below $0.000000480. On the lower side, the near-term support is $0.000012. Any break below the target is $0.20/$0.10. Any violation below $0.10 targets $0.0070.

The immediate resistance stands at around $0.0000015. Any breach above confirms bullish continuation. A jump to $0.000001580/$0.0000018/$0.00000200 is possible. A surge past $0.000002250 will take it to $0.00000250.

It is good to buy on dips around $0.0000010 with SL around $0.00000080 for a TP of $0.000002250.

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data