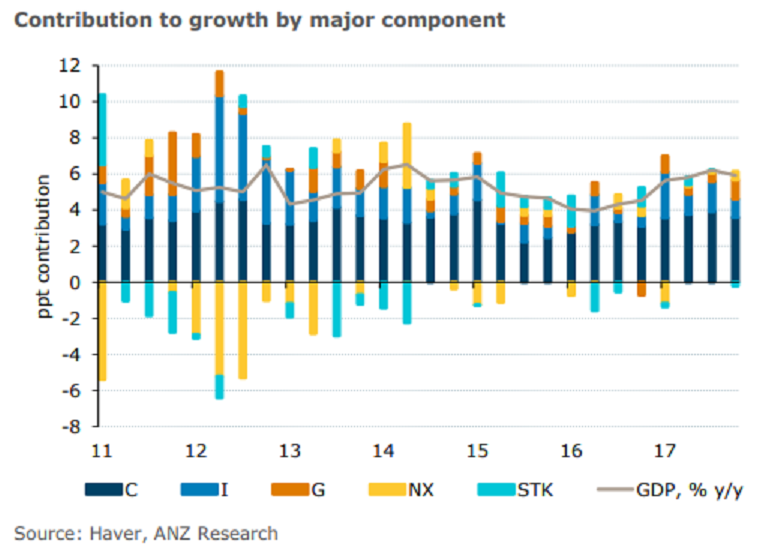

Malaysia’s full-year economic growth is expected to remain solid at 5.8 percent y/y, according to a recent report from ANZ Research. The country’s Q4 GDP growth moderated to 5.9 percent y/y and 0.9 percent q/q (s.a.) from 6.2 percent y/y in the previous quarter.

This translates into a 5.9 percent increase for the full year 2017, up from 4.2 percent in 2016. Underpinning this performance was continued strength in private consumption and investment as well as a pick-up in government consumption.

The moderation in investment was largely in the public sector presumably reflecting the lumpiness of government infrastructure projects. Private investment, on the other hand, strengthened during the quarter. Overall, the full year 2017 growth was solid and broad-based.

However, the outlook for 2018 is positive, reflecting a combination of favorable external and domestic demand conditions. The spill-over from external to domestic demand via higher manufacturing sector wages and investment activity has been quite prominent in Malaysia. The positive growth outlook is also consistent with the consumer and business sentiment data.

"BNM’s more constructive outlook on inflation notwithstanding, we believe that it will take advantage of this phase of strong growth to further normalize monetary policy. We continue to expect a 25bps hike in September, taking the year-end policy rate to 3.50 percent," the report added.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out