Bank of America Merrill Lynch says..

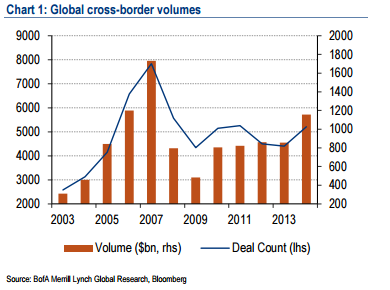

- In a note published last year we analyzed the impact of cross-border M&A activity on currency markets.

- We concluded that the impact of M&A is a far more pervasive driver for FX via the FDI channel rather than via the announcement effect.

- The analysis was particularly relevant at the time against the backdrop of the emerging trend of policy and growth divergence.

- These divergences have grown since then, as 2015 has become the year of the central bank policy surprise.

- For FX markets, such divergences have inevitably led to focus on the capital flow channel as a key driver for FX markets.

- As our Global Fund Manager Survey has highlighted in recent months, the investment community has traded this divergence consistently since the start of the year against the backdrop of US growth outperformance, and subsequently, ECB QE.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX