With the continued fall in crude prices and concomitant reduction in domestic motor fuel prices pulling down these prices virtually to the same level as the pre-hike level, the BI no longer felt the need for a tighter monetary policy.

With inflation continuing to surprise on the downside (both January and February CPIcontracted on a monthly basis), there is clamour for a rate cut to allow the currency to weaken even further and thereby provide a boost to a struggling economy.

Societe Generale notes....

- We believe that the BI's decision to cut the rate 25bp in February was aimed more at reversing the inter-meeting decision (in November 2014) to hike the rate at a similar magnitude after prices of subsidised motor fuel were raised.

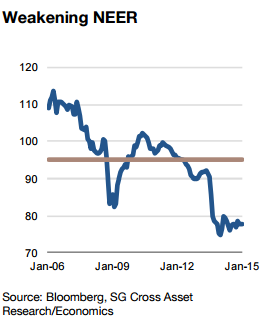

- Even in NEER (Nominal Effective Exchange Rate) terms, it is down by nearly 18% vis-a-vis its 10-yr average.

- Exports continue to contract despite the weak currency. Add to that the Chinese slowdown and the situation could turn grim. Fact is, strong capital inflows (in search of yield) and the resultant BoP surplus have failed to prevent the currency from depreciating.

- This exposes the inherent structural weakness in the economy. Any desire to provide a boost to the economy by reducing interest rates would only succeed in increasing the current account deficit and lead to further currency weakness.

- This will scare away foreign investors, both in the form of FDI and/or portfolio investments. We believe BI would do well to keep the rate unchanged rather than opt for a rate cut.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX