Logitech recently acquired the gaming peripheral maker Saiteck for a sweet $13 million deal. This puts the computer accessory provider in a position to take advantage of the emerging virtual reality gaming market, which is predicted to take off in the coming years.

Saiteck specializes in making peripherals used for controlling simulation games, Tech Times reports. With practically every analyst saying that the VR market is going to be huge, it’s reasonable to expect that Logitech would want to cash in too.

The company already has a pretty significant presence in the gaming market thanks to the mouse and keyboard innovations it has introduced over the years. Logitech also managed to provide every day, regular folks with reliable devices for work or personal use.

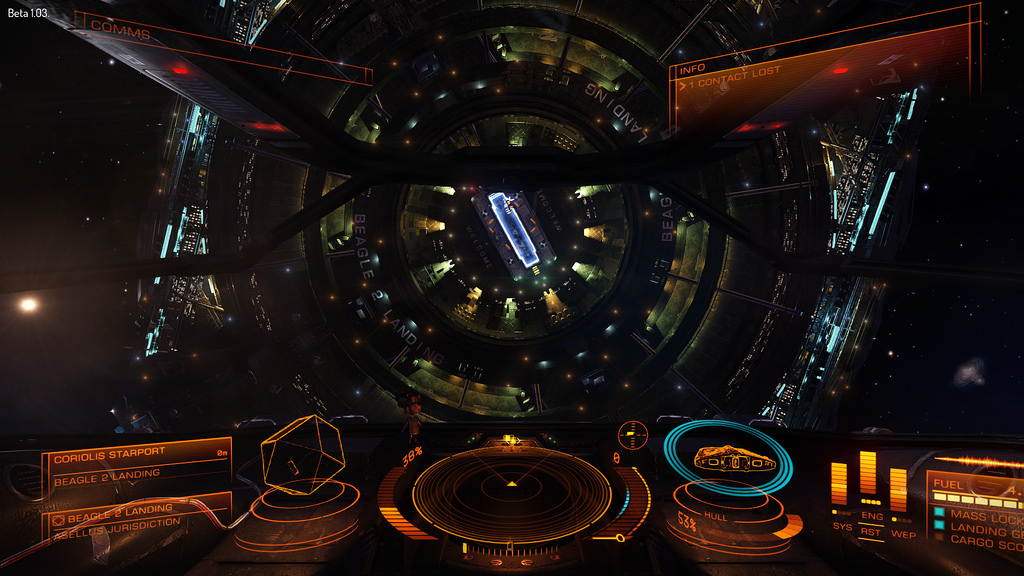

However, the company explains that there is a cult following for Saiteck products in the gaming market, especially among those who play games like the space-faring simulation “Elite: Dangerous” and “Star Citizen.” Seeing a potentially huge market for similar games that will be VR-enabled, Logitech indicated in an official statement that it plans to take full advantage of it.

“Whether you're into driving, flying or exploring space, there are fresh new titles available and more to come," the post reads. "Some of these titles are even VR enabled and we believe that dedicated controllers will stimulate and enhance the total VR experience."

Speaking of total VR experience, Saitek had been creating a custom controller for the game “Star Citizen.” The controller was meant to provide players with a truly immersive playing experience, putting them in the pilot’s seat when flying spaceships and the like. However, this project was initiated when the maker was still owned by Mad Catz.

Now that Saitek is with Logitech, the future of the custom controller is in question. Polygon tried to reach out to the company for information, but Logitech chose to be more general about its response.

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz

SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates