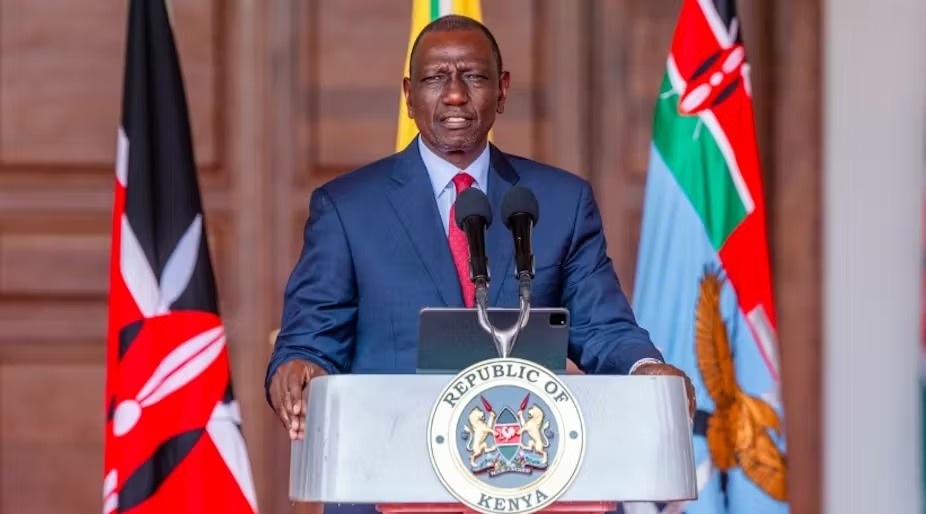

Kenya’s President William Ruto announced that his country expects to sign a trade deal with the United States by the end of 2025, while also urging Washington to extend the African Growth and Opportunity Act (AGOA) for at least five years. Speaking on the sidelines of the United Nations General Assembly in New York, Ruto emphasized that AGOA remains a vital framework for strengthening U.S.-Africa trade relations. The 25-year-old agreement, which provides duty-free access to African exports, is set to expire soon, raising concerns about its future.

Ruto noted that he plans to discuss AGOA with U.S. Secretary of State Marco Rubio, stressing that the platform helps reduce trade deficits and creates opportunities for both economies. However, uncertainty surrounds its renewal, especially after a bipartisan effort to extend it last year failed in Congress. The return of Donald Trump to the White House, along with his tariff-driven policies, has further complicated the outlook.

Despite these challenges, Ruto expressed optimism about bilateral talks, revealing that “good progress” has been made on a U.S.-Kenya trade agreement. In April, Trump imposed a 10% tariff on Kenyan goods, but Nairobi is seeking expanded access for textiles, apparel, tea, coffee, avocados, and new sectors such as mining and fisheries. If finalized, the agreement would mark the first U.S. trade pact with a sub-Saharan African nation.

Ruto also addressed regional and global security concerns. He highlighted Kenya’s involvement in Haiti, where armed gangs control most of Port-au-Prince, displacing over a million people. He urged the international community to provide more logistical, financial, and military support to the Kenyan-led mission. On the Democratic Republic of Congo, Ruto said discussions are planned involving the U.S., Qatar, and regional blocs to address ongoing conflict.

At a time when trade and security challenges intersect, Kenya is positioning itself as a key African partner for Washington.

Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links

Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links  U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday

U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday  TrumpRx.gov Highlights GLP-1 Drug Discounts but Offers Limited Savings for Most Americans

TrumpRx.gov Highlights GLP-1 Drug Discounts but Offers Limited Savings for Most Americans  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue

Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  New York Legalizes Medical Aid in Dying for Terminally Ill Patients

New York Legalizes Medical Aid in Dying for Terminally Ill Patients  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure