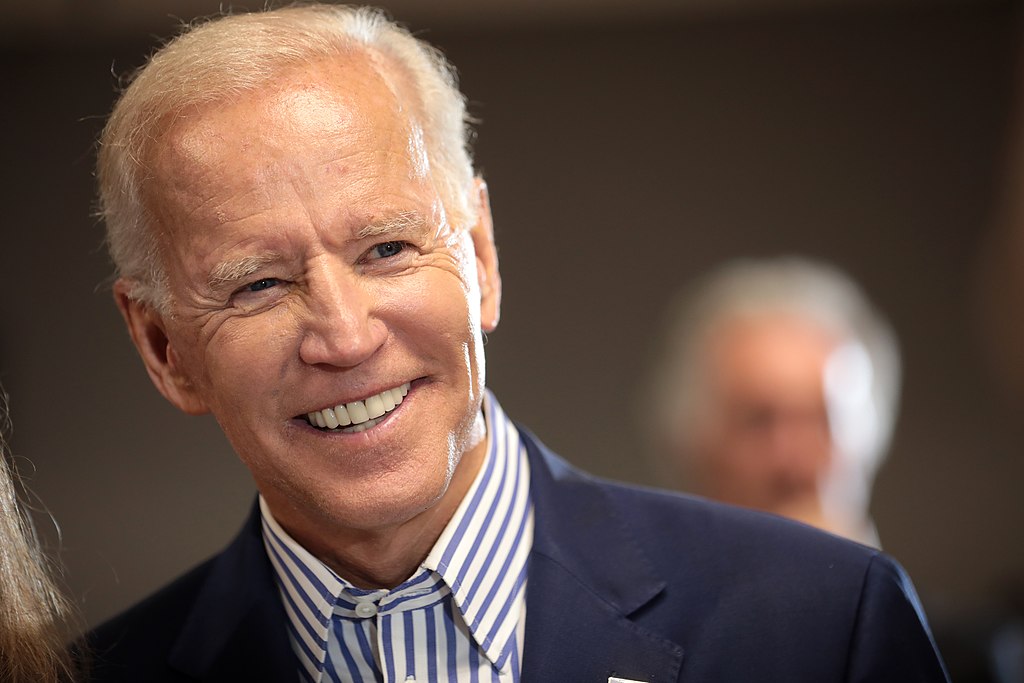

President Joe Biden has proposed raising the capital gains tax to an unprecedented 44.6% in a bold fiscal move, targeting the wealthiest Americans. This hike is part of his 2025 budget proposal to reduce income inequality.

Joe Biden's 2025 Budget Proposal Targets Wealthy with 44.6% Capital Gains Tax Increase

According to Forbes, this provision was added to Biden's budget proposal for fiscal year 2025. A footnote in the General Explanations of the Administration's Fiscal Year 2025 Revenue Proposals reads:

“A separate proposal would first raise the top ordinary rate to 39.6 percent … An additional proposal would increase the net investment income tax rate by 1.2 percentage points above $400,000 … Together, the proposals would increase the top marginal rate on long-term capital gains and qualified dividends to 44.6 percent.”

A key suggestion provides context for the aforementioned statement: boosting the long-term capital gains and qualifying dividends taxes for taxpayers to 37%. CoinGape reported that this is for taxpayers with more than $1 million taxable incomes. The 44.6% rate can only be implemented through a different proposal from the president's administration's major capital gains rate increase.

Similarly, this rate would only apply to those with taxable incomes of $1 million and $400,000 in investment income. Presenting such a capital gains rate plan is a sophisticated policy ploy that will most likely result in a high percentage while neglecting the critical issue of income thresholds.

The strategy appears to be seeking to level the playing field between high ordinary and investment-income people.

IRS Introduces New 1099-DA Form to Simplify Crypto Tax Reporting Amid Rising Tax Rates

As the administration pushes to raise taxes, many firms and individuals who may be affected may turn to digital assets to help them achieve economic freedom. At the very least, the laws governing crypto tax reporting have not yet been completely implemented, and they do not need a tax rate as high as Biden proposes.

A few days ago, the US Internal Revenue Service (IRS) released an early draft of a new tax form for reporting cryptocurrency transactions.

The form, 1099-DA, is intended to facilitate and simplify tax liabilities associated with cryptocurrency transactions. It tracks taxable profits and losses and includes sections that identify specific token codes, wallet addresses, and other transaction details.

Many investors are expected to find the form simple to complete, especially since several tax specialists tried to explain the proper procedure.

Photo: Gage Skidmore from Peoria, AZ, United States of America, CC BY-SA 2.0, via Wikimedia Commons

U.S. Condemns South Africa’s Expulsion of Israeli Diplomat Amid Rising Diplomatic Tensions

U.S. Condemns South Africa’s Expulsion of Israeli Diplomat Amid Rising Diplomatic Tensions  Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links

Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers

SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers  Newly Released DOJ Epstein Files Expose High-Profile Connections Across Politics and Business

Newly Released DOJ Epstein Files Expose High-Profile Connections Across Politics and Business  Federal Judge Blocks Trump Administration Move to End TPS for Haitian Immigrants

Federal Judge Blocks Trump Administration Move to End TPS for Haitian Immigrants  Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy

Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy  US Pushes Ukraine-Russia Peace Talks Before Summer Amid Escalating Attacks

US Pushes Ukraine-Russia Peace Talks Before Summer Amid Escalating Attacks  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand

Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026