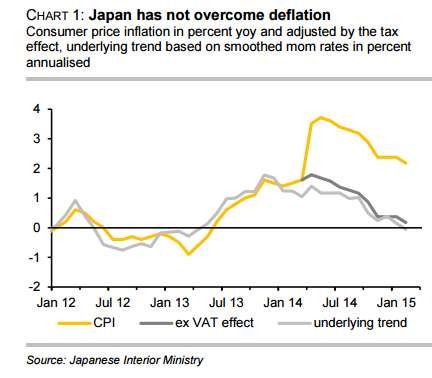

The rate of inflation was meant to reach 2% within the space of two years, the Japanese central bank had said in 2013. That does not seem to have worked out.

Even though the statistics for February record a level of 2.2% yoy, adjusted by the effect of the sales tax hike in April 2014 the rate is more or less at zero - and displaying a downward trend. Optimists might hope that all this might simply be the effect of the recent fall in the oil price.

The core rate - i.e. inflation excluding the volatile components "energy" and "fresh food" - is even lower at 2.0%.

According to Commerzbank there are two reasons for this:

(1) Food prices have risen notably in Japan therefore making the overall inflation rate seem better than it is.

(2) The energy component only made a relatively small negative contribution to overall inflation. Energy prices in Japan are only 2.1% below the previous year's level - a result of the yen depreciation in Q4/2014. In other countries the fall of the oil price had a much more notable effect. In the US for example energy prices in the CPI basket are 19% below the level recorded 12 months ago.

Japan's reflationary efforts seem to have failed

Monday, March 30, 2015 5:41 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX