Undoubtedly Chinese economy has slowed down considerably in past few years, as evident from many economic dockets, such as GDP (which has slowed to 7%, slowest in more than a decade), industrial production (from double digit growth to 6% as of last month).

However there may be more than ordinary visible slowdown, and if we keep staring at industrial production and construction to recover and move again to double digit pace, we might miss the actual recovery.

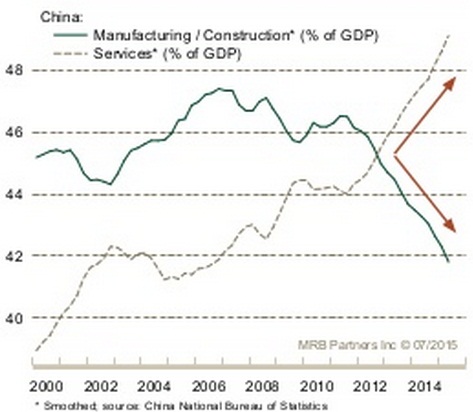

Chinese economy, as evident from the graph (chart courtesy Soberlook.com) is under major economic shift. The current has been there for quite some time now, but actually gathered pace since the crisis.

Before financial crisis of 2008/09, manufacturing and construction were contributing to more than 47% GDP and services back in 2000 were contributing less than 40% to GDP.

As of now, manufacturing and construction are contributing to less than 42% and it is likely to drop further and services are closing in to contribute almost 50% to China's total GDP.

This week PBoC attempted to improve the odds in favor of China's ailing manufacturing via three consecutive Yuan devaluation (-1.9% on Tuesday and -1.6% and -1.1% thereafter). It might improve competitive advantage for Chinese products but underlying shift is unlikely to change.

China is clearly shifting from global manufacturing hub to a service oriented economy and manufacturing is likely to play lesser role over the coming years.

So it is of high importance that we bring services indicators, which have been showing considerable strength (China services PMI in July at 53.8, highest in almost a year) into our radar along with the manufacturing ones.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?