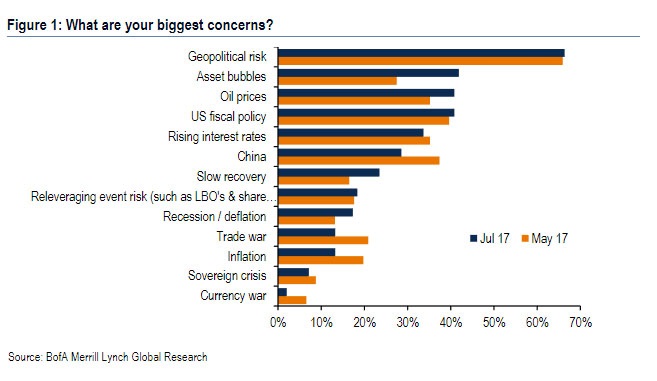

Bank of America Merrill Lynch’s (BofAML) global fund managers’ survey that takes into account more than 200 fund managers across the world with almost $700 billion under management shows that global investors are worried most about the geopolitical risks around the world. Here is the list of risks that making the investors most nervous,

- Almost 70 percent of the fund managers surveyed remain most concerned about the Geopolitical risks around the world.

- More than 40 percent of the fund managers expressed concerns over asset bubbles.

- 40 percent of the fund managers expressed worries on oil price. Almost similar numbers of asset managers expressed worries on the US fiscal policies.

- It also shows that, while China, trade war and inflation still remains top concerns, the level of anxiety with regard to these have declined.

- Concerns have increased over slow recovery and chances of deflation or reflation.

- Concerns with regard to China’s economic outlook and interest rate rise have abated somewhat.

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target