Bracing USD demand/positive UST yields seemed to restrain any further up-move.

Gold seesawed between tepid gains/minor losses through the early European session and was seen consolidating overnight strong gains to over one-week tops.

The effects of the latter on the FX market, on the other hand, are more difficult. Is there a risk of USD appreciation witnessed since mid-April collapsing now that Trump is considering possible tariffs for car (part) imports into the US? The answer is No.

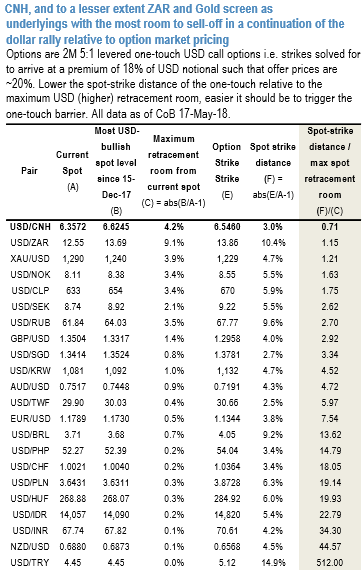

Find the best value in USD calls, judging from the number of queries on the topic recently, real money investors are increasingly beginning to devote option premium to hedge against a continuation of the dollar rally.

On this front, the above nutshell demonstrates a simple relative value screen for short-dated one-touch (OT) USD call options that provide highly leveraged exposure to dollar strength. The rich/cheap measure for directional (not delta-hedged) options used in the table is the ratio of spot-strike distance of 2M 5X geared (i.e. 20% price) OTs deflated by the maximum retracement headroom for the dollar since the onset of the USD downtrend in mid-December; smaller the ratio, less the heavy lifting required of spot to trigger the maximum option payout.

Gold is another interesting underlying to consider dollar longs in. The JPM macro view on the yellow metal remains bullish, but technicals are a key risk as the break below 200D MA could bring further liquidation of spec length.

Front-end risk-reversals in gold have narrowed recently but are still bid for calls, suggesting a degree of complacency/stale positioning that could yet be unwound should dollar strength continue.

At the end of April, the dollar definitively broke out of a narrow range established since mid-January. The move higher in the 10-year Treasury yield was chiefly cited as the driver for the 2% move higher in the broad dollar index. The dollar’s resurgence since April 18 synced with the surge in yields but also the 2% drop in spot gold prices. This sequence of events would normally be considered mundane were it not for the fact that the typical persistently-negative relationship between yields (both nominal and real, short-term and intermediate), and the gold price has broken down since last October.

It is still early days and debatable whether the period of decorrelation has ended. Given that our FX strategists maintain forecasts for a weaker USD over the next couple of quarters, we prefer to keep our long gold trade recommendation in place for now.

Additionally, short-dated gold vols are priced near all-time lows, are one of the most depressed on a cross-asset basis, and are better owned relative to longer-dated vols along a steeply upward sloping curve, hence, there is genuine value in 1M-3M option bets on tactical price declines.

Initiated longs in CME gold for Dec’18 delivery at $1,352.80/oz in February 2018. Subsequently, added an equivalent unit at $1,327/oz in March as well for a new entry level of $1,339.90/oz. Trade target is $1,540/oz with a stop at $1,273/oz. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand