Intel unveiled an extensive investment strategy totaling US$100 billion spread across four states in the U.S. The tech giant aims to construct and enhance factories after acquiring US$19.5 billion in federal grants and loans. Additionally, Intel is eyeing an extra US$25 billion in tax incentives to fuel its growth.

The Vision for Columbus, Ohio

CNA reported that at the heart of Intel's five-year initiative lies the transformation of vacant lands near Columbus, Ohio. CEO Pat Gelsinger envisions this location as the future home of "the largest AI chip manufacturing facility globally," with operations anticipated to commence by 2027.

Federal Support and Market Response

Under the CHIPS Act, the U.S. government's allocation of federal funds to Intel triggered a 4% surge in its premarket trading shares. This financial backing sets the stage for Intel's rejuvenation and expansion efforts across multiple states.

Intel's strategic blueprint, as per Reuters, involves modernizing facilities in New Mexico and Oregon while expanding operations in Arizona. This move aligns with the broader industry trend as Taiwan Semiconductor Manufacturing Co. established a significant Arizona plant.

President Joe Biden's push for advanced semiconductor manufacturing within the U.S. has fueled Intel's resurgence plans. The financial provisions under Biden's initiative mark a pivotal step for Intel to enhance its market standing and operational capacities.

In 2021, Gelsinger outlined a bold strategy to reclaim Intel's top position in the industry. However, achieving profitability in this endeavor necessitates substantial government backing, a critical component for Intel's future success.

Investment Allocation and Operational Milestones

Around 30% of the US$100 billion allocation will be directed toward construction expenses, encompassing labor, infrastructure, and materials. The remaining budget will be allocated to procuring cutting-edge chipmaking tools from prominent industry suppliers.

Gelsinger anticipates the Ohio facility's operational by 2027 or 2028, depending on market conditions. Despite the meticulous planning, timeline adjustments in response to the dynamic chip market landscape remain possible.

Sustainable Growth through Strategic Investments

Intel plans to utilize existing cash flows for acquisitions, emphasizing sustainable growth. The strategic purchase of chipmaking tools from leading suppliers will bolster Intel's competitive edge and propel its trajectory toward technological advancement and market leadership.

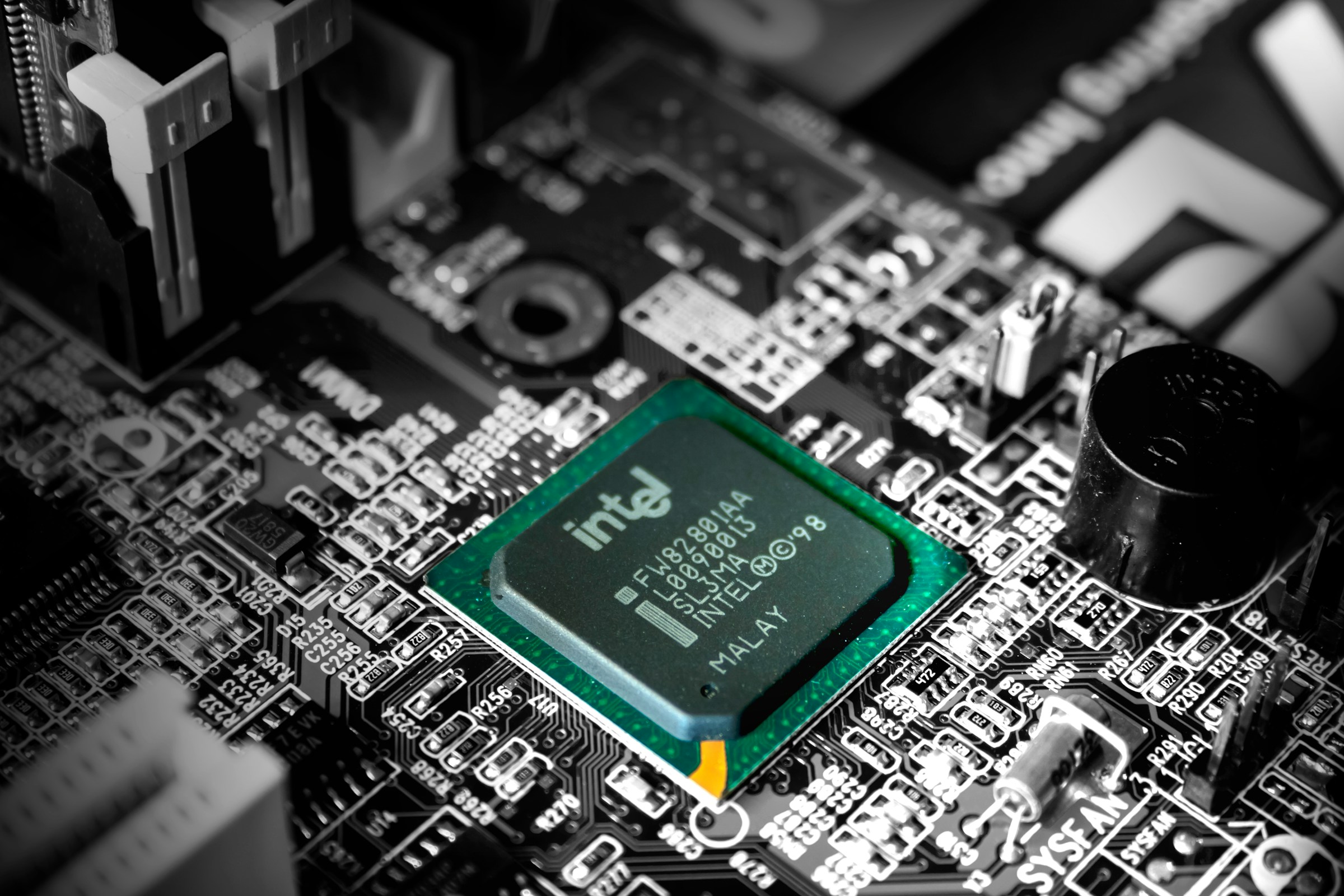

Photo: Slejven Djurakovic/Unsplash

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile

Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge