Recent financial market turmoil and lower price of commodities including energy has made it tough for US central bankers to go ahead with a rate hike in immediate policy meeting scheduled for September 16th/17th.

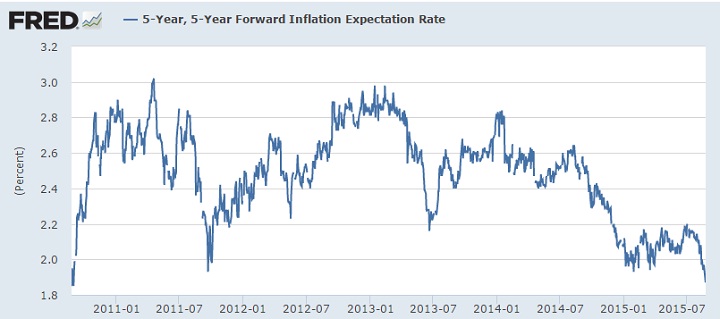

While survey based inflation expectation has remained stable, market bases measure has dropped to lowest level not seen since August 2010, when financial market was on its recovery from 2008/09 slump.

- Inflation expectations as measured by 5 year- 5 year (5y/5y) forward inflation expectation calculated using swap dropped to 1.87% as of Monday, a level not seen in 5 years.

With global energy and commodity prices at multi decade low, FED doves are going to argue strongly against a rate hike next month as lower inflation provides FED with opportunity to see further improvement in the economy as well as labor market.

Rise in global volatility has pushed investors to the safety of treasuries, which has pushed expectations of inflation down.

Sudden devaluation of Chinese currency by PBoC this month has opened up Pandora's Box of volatility and fear that China will be importing some of its deflation and volatility to the global market.

US benchmark stock index, S&P500 is still struggling to pose sustained comeback after Monday's aggressive selloff, currently trading at 1900.

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility