Indonesia's demand conditions (both domestic and external) remain weak and the weakness is expected to persist for some more time. During the quarter ending June 2015, household demand growth fell below 5% for the first time in four years.

In addition, the BI (Bank of Indonesia) retail sales survey is at its lowest level on a quarterly basis, indicating persistent weakness. On the external front, exports contracted for the thirteenth straight month, with the September quarter witnessing the highest contraction of the year.

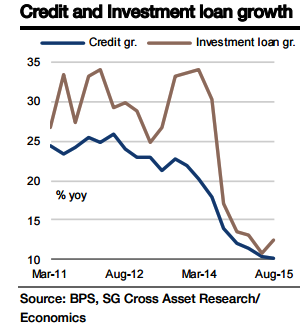

Not surprisingly, credit growth remained anaemic, while the PMI stayed in contraction territory for the twelfth consecutive month. The huge contraction in non-oil imports also indicates the extent of the weakness in domestic activity.

On the positive side, infrastructure investment is slowly starting to pick up, though a major impact is not expected this year. This is also visible in the slight uptick in investment loans. The recent bout of reform announcements by the government is highly positive for the economy, though we expect only a limited impact in the short to medium term.

"The key, however, remains the government's ability to implement the reforms. Overall, the economy looks less conservative for the full year 2015. Indonesia's GDP growth is expected to have slowed down even further in Q3 2015 to 4.63% yoy from the 4.67% yoy recorded in Q2 2015", says Societe Generale.

Indonesia's overall demand remains a major concern

Monday, November 2, 2015 4:46 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022