The economy needs to diversify out of commodities but this is proving more difficult than expected. Growth in manufacturing has yet to improve, despite efforts to revitalize the sector. Production efficiency seems to be the main problem; it seems to have worsened in recent years.

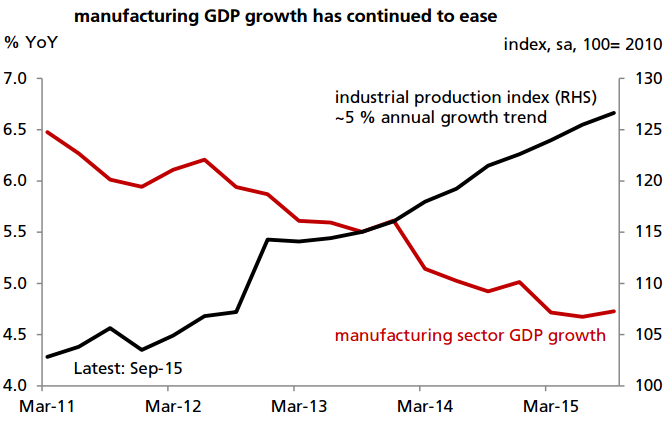

Manufacturing is the preferred sector as the economy shifts away from commodities. This is important to ensure job creation as the population expands. While industrial production has continued to grow at 5% pace since 2011, manufacturing GDP growth has actually moderated to 4% from an average of 6% in 2011-12. GDP would have grown by 5.1% this year, instead of 4.7%, had the manufacturing sector maintained its 2011 growth pace.

Part of the slowdown is due to the weak global economy. Exports of manufactured goods are growing at a mere 2% per annum. Still, relative to elsewhere in South-east Asia, the weakness in manufacturing seems pronounced. Production efficiency needs to rise. One measure of efficiency is the ratio of investment to the increase in GDP, commonly known as the ICOR (incremental capital output ratio). Plainly put, this measures how much total investment is needed to generate an extra dollar of production every year.

Indonesia's ICOR stood at 6.8 in 2014, among the highest (least efficient) in the past 25 years. Since 2011, it has averaged 6.0, higher than most in the region. Clearly, improvements are needed. While GDP growth is expected to tick higher to 5.2% in 2016, and to around 5.5% in 2017, President Widodo's target of 7% GDP growth by 2019 seems a stretch. That several members of the cabinet still talk about the 7% GDP growth with strong conviction is presumably an effort to boost confidence in the public, especially among business owners.

Over-optimism could backfire. One year ago, the government had targeted 5.8% GDP growth for 2015, on the back of a doubling in infrastructure budget. Realization of the budget has been extremely slow however, and this has lowered sentiment and real investment. Private consumption remains resilient and continues to anchor overall GDP growth. But the government needs to keep its focus in improving the structural impediments that have long hampered growth. Failure to do so would eventually hit consumption as well.

Indonesia's manufacturing sector has continued to slow

Thursday, December 3, 2015 11:07 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX