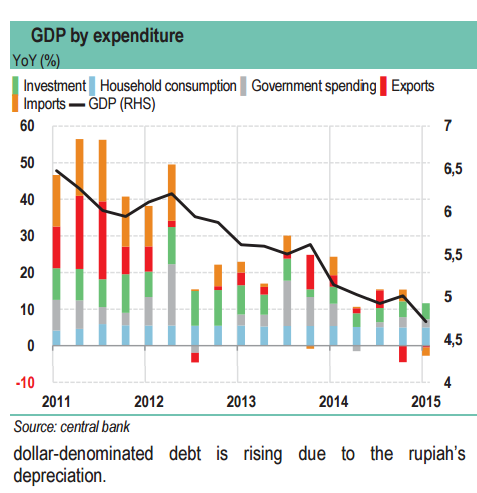

In Q1 2015, GDP growth continued to slow to only 4.7% yoy (down from 5% in Q1-2014), the slowest pace since the 2009 crisis. Household consumption remained relatively robust, but exports continued to contract for the second consecutive quarter.

The slowdown was particularly sharp in the mining industry, reflecting the decline in commodity prices, but also the contraction in production volumes following the export ban on certain unprocessed mining products since 1 January is also hurting from the economic slowdown in China, its second largest trading partner since 2009. China's share of Indonesian exports dropped from 12.4% in 2013 to 10% in 2014.

The ongoing slowdown in the Indonesian economy since 2012 can be attributed to the structure of the economy. One of its main weaknesses is its heavy dependence on commodities, even though the situation has improved over the past three years, notably due to the decline in oil production. In 2014, commodities accounted for an estimated 9% of GDP.

Commodity exports accounted for 54% of the total, and 20% of government revenues were derived from the exploitation of commodities. It is thus easy to understand why growth has slowed sharply since the drop-off in international commodity prices. As long as coal, palm oil, rubber and oil prices held at high levels, the country's economic growth exceeded 6%. Yet the World Bank now estimates its growth potential at only 5.5% if commodity prices were to hold at current levels. Even though Indonesia has become a net oil importer, the oil bill has not fallen enough to offset the impact of the decline in commodity prices on the economy as a whole.

The slowdown continues in Indonesia

Tuesday, July 14, 2015 2:03 AM UTC

Editor's Picks

- Market Data

Most Popular

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm