The expected marginal increase in CPI inflation is unlikely to prompt inflation concerns, however, it remains benign.

After the Reserve Bank of India's decision to cut the repo rate 25bps to 7.50% on 4 March, expectations of another rate cut at the 7 April policy meeting are subdued.

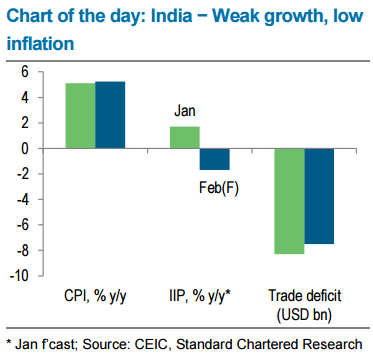

The IIP is expected to contract 1.7% y/y, following a 1.7% rise in December. An export decline of 11.2% y/y (-1.4% in December) and weak auto-production growth of 2.0% y/y (6.3%) likely dragged the IIP into contractionary territory.

Standard Chartered Bank notes in a repot on Wednesday:

- We expect February CPI inflation (due on 12 March) under the new series (base year: 2012) to have been 5.25% y/y, marginally higher than 5.1% in January. Higher energy costs and a slower decline in food prices likely put upward pressure on headline CPI inflation.

- We expect core inflation to have increased marginally to 4.0% y/y (3.9% in January), as transport costs likely moved higher on recent gasoline and diesel price hikes.

- The rates market is expecting a CPI inflation print below 5% and we think it would be disappointed with anything above 5%. As such, a 5.25% print is likely to lead to a 3-5bps rise in the benchmark 10Y Indian government bond (IGB) yield.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX