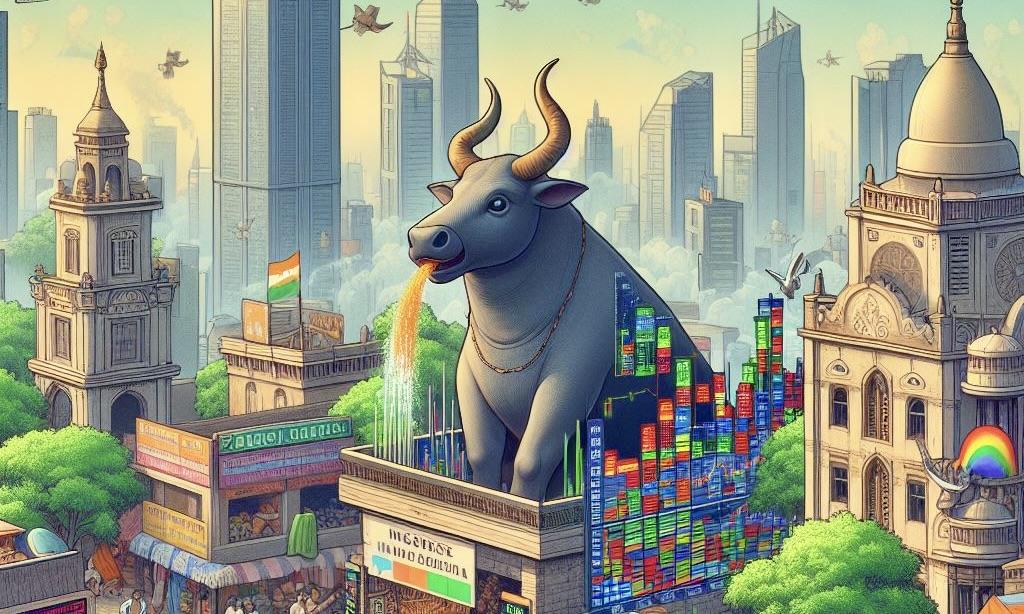

India's buoyant stock market is witnessing a surge in initial public offerings (IPOs), although concerns arise over the tepid performance of many listings in Mumbai.

Investors and analysts note the optimistic outlook for India's economic growth, bolstered corporate earnings, and robust demand from foreign investors, contributing to the momentum of deals. Dealogic data highlights that in January, 21 IPOs raised approximately $678 million, a stark contrast to the $17 million raised during the same period last year.

Growth Amid Valuation Concerns

Despite the promising trend, market analysts caution against elevated valuations, spurred by a 20% rise in India's benchmark Sensex stock index over the past year.

Kunal Vora, head of India equity research at BNP Paribas, acknowledges the positive fundamentals and growth prospects but underscores concerns regarding valuation levels. Noteworthy companies poised for IPOs include Ola Electric and the fintech group MobiKwik.

India's Ascendancy in the IPO Market

India's IPO market experienced revitalization last year, propelled by robust corporate earnings and heightened investor interest domestically and internationally.

This enthusiasm contributed to India's stock market capitalization reaching approximately $4 trillion, surpassing Hong Kong as the seventh-largest market globally. Additionally, Indian IPOs raised nearly $8 billion in funds last year, reflecting the country's emergence as a critical player in the global IPO landscape.

Economic Momentum and Investor Preference

India's economy has emerged as one of the fastest-growing globally, with an anticipated expansion of 7% this year. Geopolitical tensions and economic uncertainties surrounding China have fueled foreign investor interest in Indian stocks.

Concerns regarding IPO performance have prompted institutional investors in India to reassess their participation in new listings.

According to Financial Times, Raamdeo Agrawal, chair of the Indian financial group Motilal Oswal, emphasizes a preference for investments in publicly traded companies due to greater financial transparency and advocates against speculative IPO investments.

Moving Forward

Despite the cautious sentiment surrounding IPOs, the Indian market attracts significant attention from domestic and international investors.

According to Bloomberg, the surge in IPO activity underscores the growing confidence in India's economic prospects and its position as a key destination for investment.

As market dynamics evolve and regulatory frameworks adapt, stakeholders remain vigilant, seeking opportunities while navigating potential risks in India's vibrant IPO landscape.

Photo: Microsoft Bing

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans