The Emerging Market (EM) has been underperforming the Developed Market since the EMU debt crisis and persistent divergence between the business cycles in both the regions has been a central feature of this economic expansion. Sustained policy support from central banks and healing in the private sectors and banking systems has helped economic growth in the DM move modestly above potential, while growth in the EM has fallen further below potential, dragged down by over-indebtedness, depressed corporate profits, and terms of trade losses.

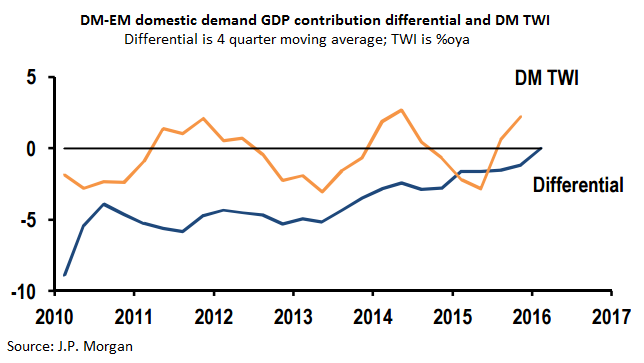

Against this backdrop, international trade has served as a balancing force. For the DM, net exports gradually have shifted from adding to economic growth to subtracting from it, with a notable deceleration in gross trade flows. DM import gains have picked up pace with domestic demand (despite some slowing last year), while exports have seen some abrupt slowdown. On the other hand these changes were mirrored by a moderation in export growth and an even sharper downshift in import growth in the EM. Data showed that net trade subtracted 0.4%-pt from DM GDP growth over the four quarters through 4Q15 and 0.5%-pt (annual rate) in the quarter itself, while it boosted 0.6%-pt in EM GDP over the four quarters through 4Q15 and 0.75%-pt in the latest quarter alone.

Shifts in income growth and relative prices affects trade flows. As noted, income effect is shifting growth from the DM to the EM. Typically, the income shift described above would be accompanied by an increase in the trade-weighted DM FX rate and a decline in the tradeweighted EM FX rate. However, in the present situation, we have not seen the expected follow-through. The DM Trade Weighted Index has hardly seen any gains at all since the EMU debt crisis.

Until last year, the divergence in economic performance, policy, and FX rates among the G-3 meant the US bore the brunt of the continued deceleration in EM GDP. In 2014, net exports subtracted 0.5%-pt from US GDP growth (4Q/4Q). The drag increased slightly to 0.6%-pt in 2015. By contrast, net exports were neutral with respect to Euro area growth in 2014 and added 1.5%-pts to GDP in Japan. The situation the latter two economies deteriorated in relative terms last year.

The price effect mainly concerns currency movements. The US dollar has staged a powerful rally the past few years and there is scope for outperformance to continue and what the dollar does and what the Fed will do will make a tremendous difference. The Fed terminated the last of its QE programs in October 2014, and has set the stage for an eventual normalization of rates that began last December. The ECB and the BoJ on the other hand have continued to ease and remain in an expansionary mode as the situation the latter two economies deteriorated in relative terms last year. However, a surprisingly dovish communication from the Fed should see these currencies strengthen against the US dollar over the balance of this year.

Issues that worried markets in 2015 have not gone away: China’s slowing economy and falling foreign exchange reserves, and the strong US dollar. EM policymakers are generating “quite comprehensive reform agendas” in a renewed effort to put their fiscal houses in order. Bruce Kasman and colleagues at JPMorgan expect economic growth in EMs and DMs to be unchanged in 2016 from 2015, at 3.7 per cent and 1.8 per cent, respectively. But they see EM growth rising to 4.4 per cent in 2017, compared with a sluggish advance to just 1.9 per cent in developed markets.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed