In autumn economic outlook, UK finance chief George Osborne announced the most ambitious housing plan, in more than four decades. He has vision to build as much as 400,000 new houses across UK to rein over rise in property prices, which has outpaced wage growth by many folds over the last few years.

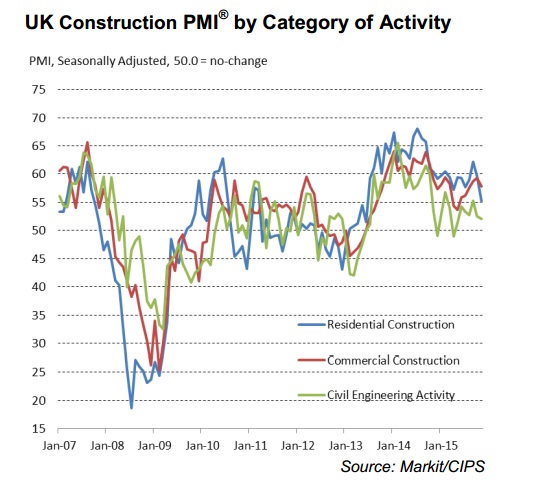

In contrast to this ambitious plan UK construction PMI is trending down. November's rise in output has been slowest since 2013. Headline index dropped to 55.3 in November, compared to 68.8 in October. The headline above 50, is still indicating growth, however new business, output and employment all is rising at much slower pace.

According to Markit economics, all broad area of construction activity experience slowdown in November. UK residential activity dropped sharply.

While construction weakens, third quarter GDP report has confirmed that UK economy is growing but not at speed seen in 2013/14.

Pound, which was already weak against Dollar, dipped further, probably on its way to recent low. Currently trading at 1.504 against Dollar.

Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding

Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding  New York Legalizes Medical Aid in Dying for Terminally Ill Patients

New York Legalizes Medical Aid in Dying for Terminally Ill Patients  Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales

Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Pentagon Ends Military Education Programs With Harvard University

Pentagon Ends Military Education Programs With Harvard University  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border

Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX