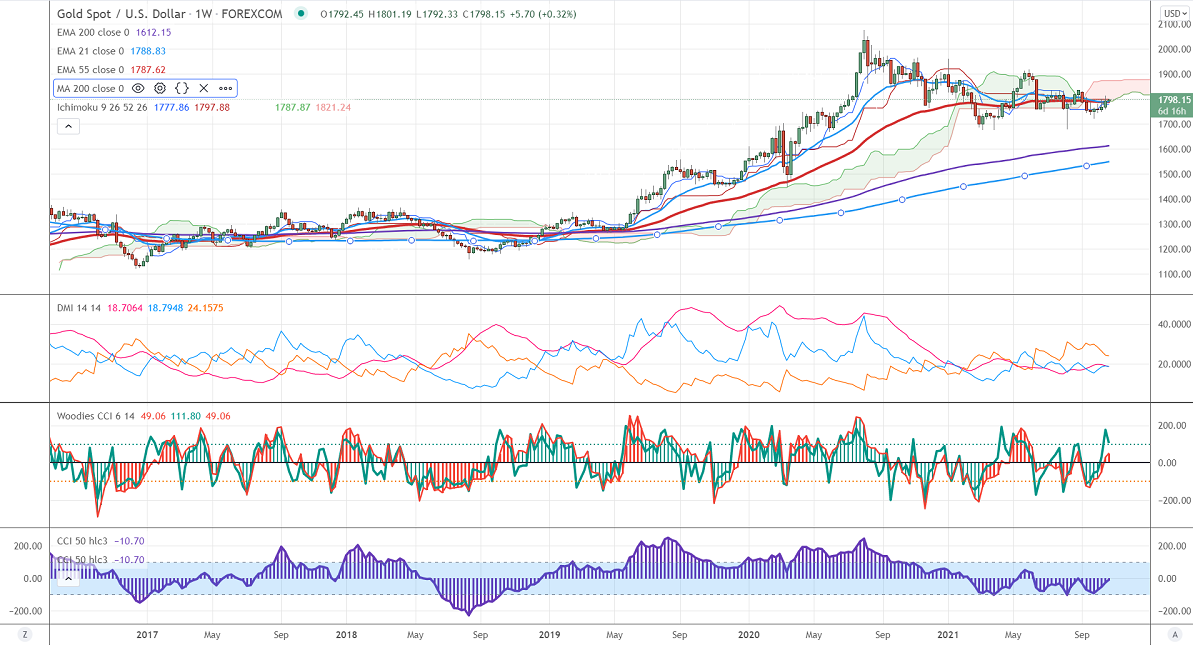

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1779

Kijun-Sen- $1797.88

Gold is trading higher and hovers near $1800 levels. The yellow metal declined pared some of its gains after Fed Chairman comments about inflation. He stated that inflation risks are cooling, it will fall back to 2%. The US dollar index continues to trade weak for the third consecutive week. Any convincing breach below 93.50 confirms further bearishness. Gold hits a high of $1813.89 and is currently trading around $1798.42.

Economic data-

US industrial production declined by -1.3% in Sep compared to a forecast of 0.30%. US housing starts fell last month to 1.56 M compared to a forecast of.1.62 million: Building permits declined sharply by 7.7%. The US Philly fed manufacturing index declined to 23.8 in Sep compared to a forecast of 25.1. The number of people who have filed for unemployment benefits dropped by 8000 to 290K the previous week vs an estimate of 298000.

Factors to watch for gold price action-

Global stock market- Slightly bullish (negative for gold)

US dollar index – Bearish (positive for gold)

US10-year bond yield- bearish (Positive for gold)

Technical:

It is facing strong support at $1778 violation below targets $1770/$1760. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1815, any convincing break above will take the yellow metal $1835/$1850/$1860 is possible.

It is good to buy on dips around $1770-71 with SL around $1760 for TP of $1835.